Question: Amazon is considering using high capacity drones that would make its product deliveries more efficient. For this project, $116,000 would need to be spent right

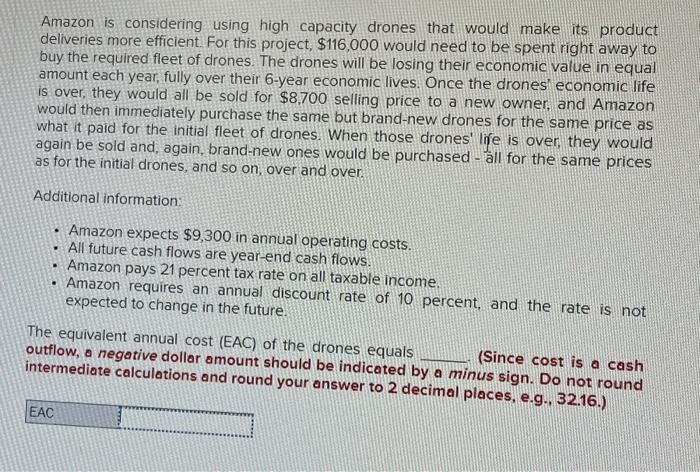

Amazon is considering using high capacity drones that would make its product deliveries more efficient. For this project, $116,000 would need to be spent right away to buy the required fleet of drones. The drones will be losing their economic value in equal amount each year, fully over their 6 -year economic lives. Once the drones' economic life is over, they would all be sold for $8,700 selling price to a new owner, and Amazon would then immediately purchase the same but brand-new drones for the same price as what it paid for the initial fleet of drones. When those drones' life is over, they would again be sold and, again, brand-new ones would be purchased - all for the same prices as for the initial drones, and so on, over and over. Additional information: - Amazon expects $9,300 in annual operating costs. - All future cash flows are year-end cash flows. - Amazon pays 21 percent tax rate on all taxable income - Amazon requires an annual discount rate of 10 percent, and the rate is not expected to change in the future. The equivalent annual cost (EAC) of the drones equals outflow, a negative dollar amount should be indicated by a... (Since cost is a cash intermediate calculations and round your answer to minus sign. Do not round aloces, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts