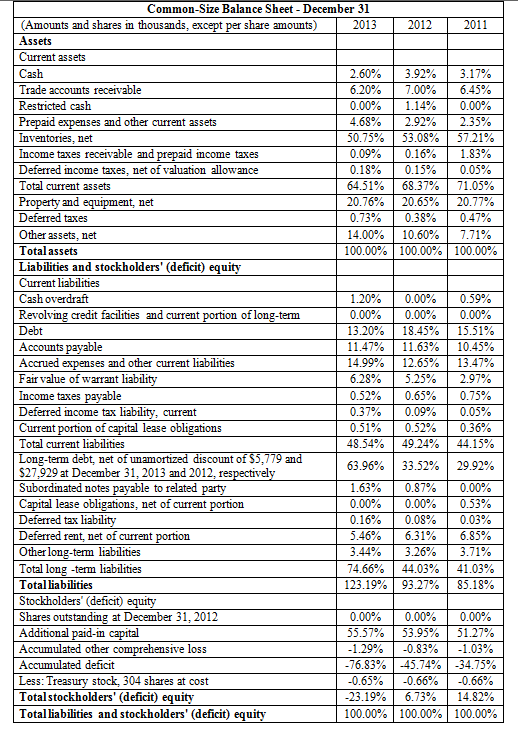

Question: American Apparel: Drowning in Debt? Analyze three major components based on the common-size balance sheets and the trends of those components over the three years..

American Apparel: Drowning in Debt?

Analyze three major components based on the common-size balance sheets and the trends of those components over the three years.. Use 10.00% as a threshold.

Common-Size Balance Sheet - December 31 (Amounts and shares in thousands, except per share amounts) 2013 2012 2011 Assets Current assets Cash 2.60% 3.92% 3.17% Trade accounts receivable 6.20% 7.00% 6.45% Restricted cash 0.00% 1.14% 0.00% Prepaid expenses and other current assets 4.68% 2.92% 2.35% Inventories, net 50.75% 53.08% 57.21% Income taxes receivable and prepaid income taxes 0.09% 0.16% 1.83% Deferred income taxes, net of valuation allowance 0.18% 0.15% 0.05% Total current assets 64.51% 68.37% 71.05% Property and equipment, net 20.76% 20.65% 20.77% Deferred taxes 0.73% 0.38% 0.47% Other assets, net 14.00% 10.60% 7.71% Total assets 100.00% 100.00% 100.00% Liabilities and stockholders' (deficit) equity Current liabilities Cash overdraft 1.20% 0.00% 0.59% Revolving credit facilities and current portion of long-term 0.00% 0.00% 0.00% Debt 13.20% 18.45% 15.51% Accounts payable 11.47% 11.63% 10.45% Accrued expenses and other current liabilities 14.99% 12.65% 13.47% Fair value of warrant liability 6.28% 5.25% 2.97% Income taxes payable 0.52% 0.65% 0.75% Deferred income tax liability, current 0.37% 0.09% 0.05% Current portion of capital lease obligations 0.51% 0.52% 0.36% Total current liabilities 48.54% 49.24% 44.15% Long-term debt, net of unamortized discount of $5,779 and 63.96% 33.52% 29.92% $27.929 at December 31, 2013 and 2012, respectively Subordinated notes payable to related party 1.63% 0.87% 0.00% Capital lease obligations, net of current portion 0.00% 0.00% 0.53% Deferred tax liability 0.16% 0.08% 0.03% Deferred rent, net of current portion 5.46% 6.31% 6.85% Other long-term liabilities 3.44% 3.26% 3.71% Total long-term liabilities 74.66% 44.03% 41.03% Total liabilities 123.19% 93.27% 85.18% Stockholders' (deficit) equity Shares outstanding at December 31, 2012 0.00% 0.00% 0.00% Additional paid-in capital 55.57% 53.95% 51.27% Accumulated other comprehensive loss -1.29% -0.83% -1.03% Accumulated deficit -76.83% -45.74% -34.75% Less: Treasury stock, 304 shares at cost -0.65% -0.66% -0.66% Total stockholders' (deficit) equity -23.19% 6.73% 14.82% Total liabilities and stockholders' (deficit) equity 100.00% 100.00% | 100.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts