Question: American Technologies, Inc. 1. American Technologies, Inc. provides an array of services to enhance a customer's cloud computing, storage and networking resources. At the close

American Technologies, Inc.

1. American Technologies, Inc. provides an array of services to enhance a customer's cloud computing, storage and networking resources. At the close 2021, it reported the financial results of its wholly owned foreign subsidiary, ATI - International Ltd., headquartered in London

Notes:

QBAI means Qualified Business Asset Investment

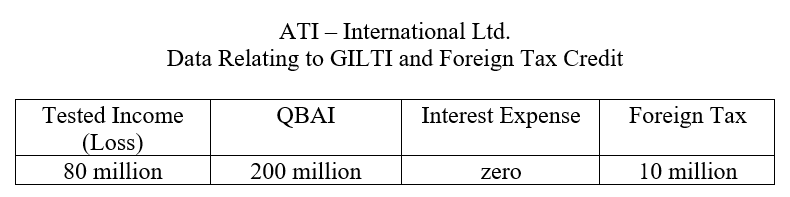

Foreign Tax means the foreign income taxes incurred by the controlled foreign corporation allocated to the §951A category income.

For 2021 American Technologies, Inc. has reported taxable income of 800 million and a U.S. income tax liability of 150 million.

• Determine the foreign tax credit American Technologies, Inc. may claim for 2021. (This requires first determining the Corporation's deemed paid foreign tax.) Assume no deductible expenses are allocated to the GILTI income other than the section 250 deduction of 50%.

a. Deemed paid foreign income tax.

b. Foreign Tax Credit Limitation

c. Foreign Tax Credit.

ATI - International Ltd. Data Relating to GILTI and Foreign Tax Credit QBAI Tested Income (Loss) 80 million 200 million Interest Expense zero Foreign Tax 10 million

Step by Step Solution

There are 3 Steps involved in it

American Technologies Inc GILTI and Foreign Tax Credit a Deemed Paid Foreign Income Tax Since ATI In... View full answer

Get step-by-step solutions from verified subject matter experts