Question: Amortization is a process in which regular payments are made to pay off a liability such as a loan or a home mortgage. These regular

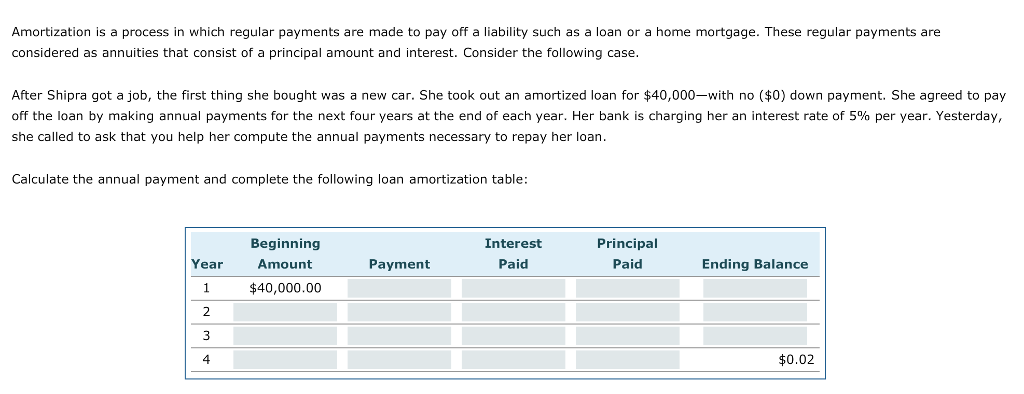

Amortization is a process in which regular payments are made to pay off a liability such as a loan or a home mortgage. These regular payments are considered as annuities that consist of a principal amount and interest. Consider the following case After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $40,000-with no ($0) down payment. She agreed to pay off the loan by making annual payments for the next four years at the end of each year. Her bank s charg ng heran terest rate of s , ervea Yesterday she called to ask that you help her compute the annual payments necessary to repay her loan. Calculate the annual payment and complete the following loan amortization table Beginning Amount $40,000.00 Principal Paid Interest Year 1 2 Payment Paid Ending Balance 4 $0.02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts