Question: Amotorization table? On December 3 1 , 2 0 2 3 , Green Bank enters into a debt restructuring agreement with Splish Brothers Inc., which

Amotorization table?

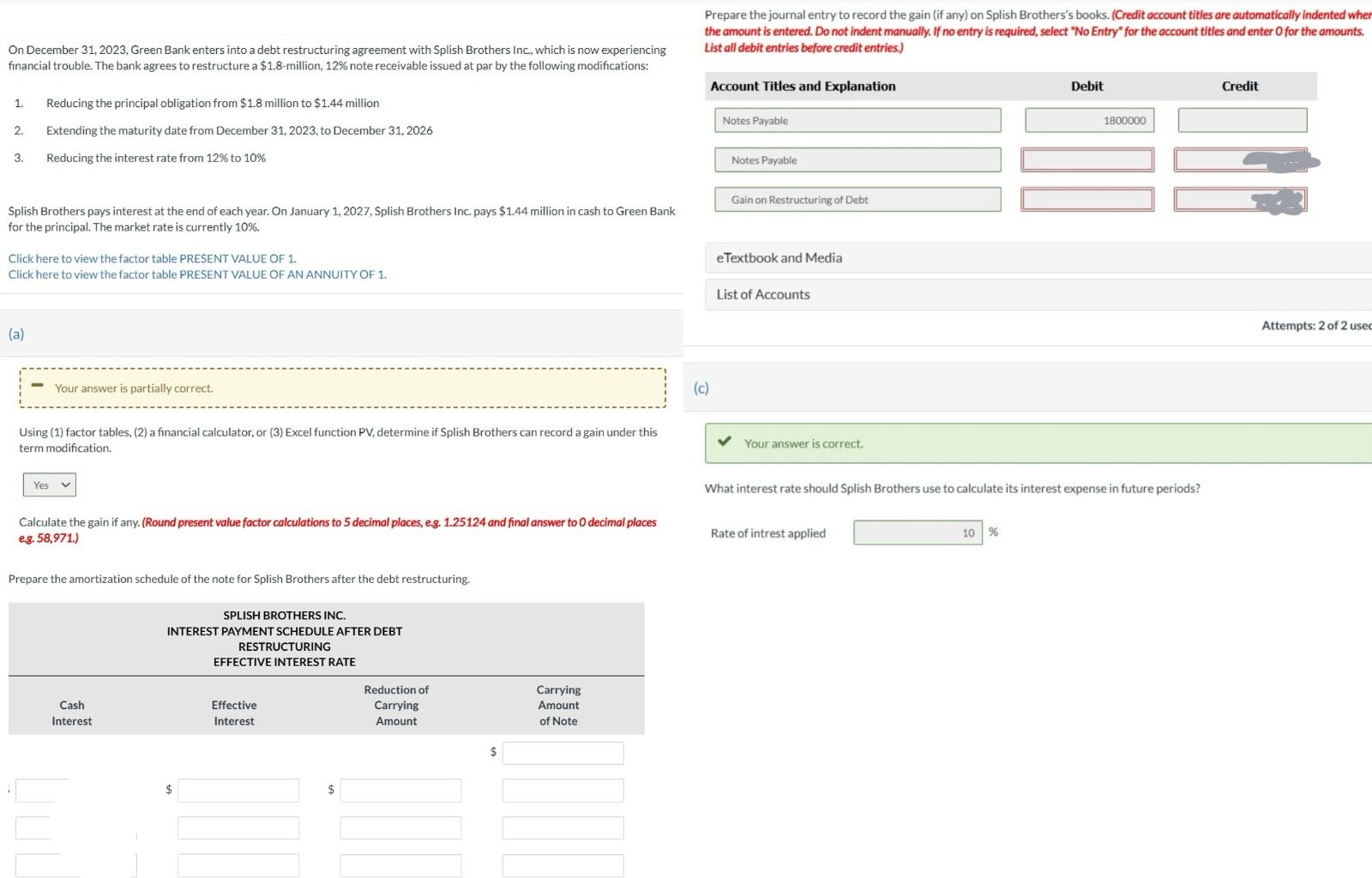

On December Green Bank enters into a debt restructuring agreement with Splish Brothers Inc., which is now experiencing financial trouble. The bank agrees to restructure a $million, note receivable issued at par by the following modifications:

Reducing the principal obligation from $ million to $ million

Extending the maturity date from December to December

Reducing the interest rate from to

Splish Brothers pays interest at the end of each year. On January Splish Brothers Inc. pays $ million in cash to Green Bank for the principal. The market rate is currently

Click here to view the factor table PRESENT VALUE OF

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF

a

Your answer is partially correct.

Using factor tables, a financial calculator, or Excel function PV determine if Splish Brothers can record a gain under this term modification.

Calculate the gain if any. Round present value factor calculations to decimal places, eg and final answer to decimal places eg

Prepare the amortization schedule of the note for Splish Brothers after the debt restructuring.

: SPLISH BROTHERS INC. INTEREST PAYMENT SCHEDULE AFTER DEBT RESTRUCTURING

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock