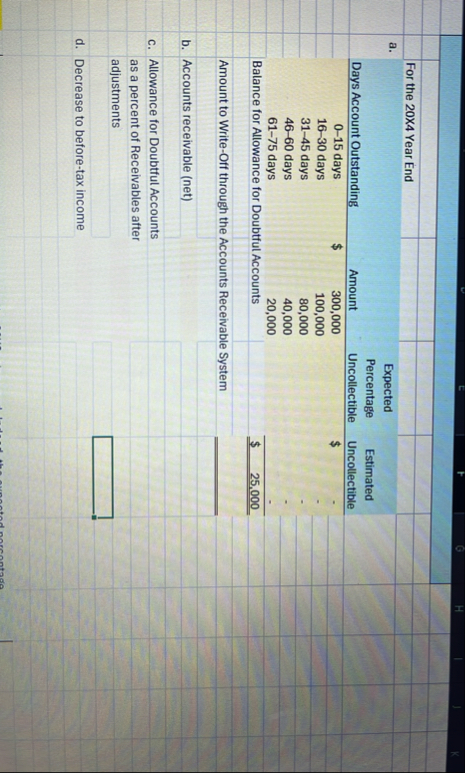

Question: Amount to Write - Off through the Accounts Receivable System q , b . Accounts receivable ( net ) c . Allowance for Doubtful Accounts

Amount to WriteOff through the Accounts Receivable System

b Accounts receivable net

c Allowance for Doubtful Accounts as a percent of Receivables after adjustments

d Decrease to beforetax income

hilow Corporation operates in an industry that has a high rate of bad debts. Before any yearend istments, the balance in Manilow's Accounts Receivable account was $ and Allowance for ibtful Accounts had a credit balance of $ The yearend balance reported in the balance et for Allowance for Doubtful Accounts will be based on the aging schedule shown below.

tabletableProbability ofCollectionLess than days,$Between and days,,Between and days,,Between and days,,Between and days,Over days to be written off$wance before Adjustments,$wance as of Receivables,,,efore adjustments,,

ructions

What is the appropriate balance for Allowance for Doubtful Accounts at yearend?

Show how accounts receivable would be presented on the balance sheet.

$

$

What is the dollar effect of the yearend bad debt adjustment on the beforetax income?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock