Question: Amp Home Training detail: Curriculum hrblock.csod.com / Evaluations / EvalLau Getting Started Amazon Small Business Particip... Acer Treasury Depa Domicile 1 / 2 Question 1

Amp Home

Training detail: Curriculum

hrblock.csod.comEvaluationsEvalLau

Getting Started

Amazon

Small Business Particip...

Acer

Treasury Depa

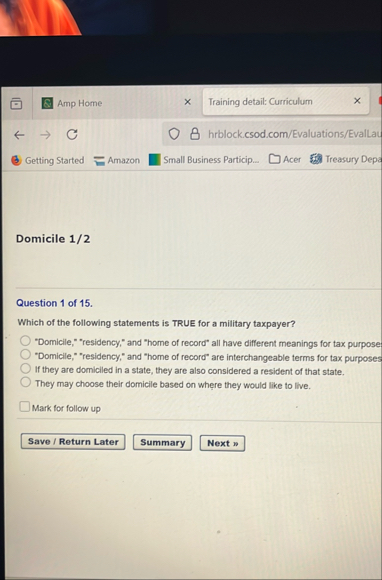

Domicile

Question of

Which of the following statements is TRUE for a military taxpayer?

"Domicile," "residency," and "home of record" all have different meanings for tax purpose:

"Domicile," "residency," and "home of record" are interchangeable terms for tax purposes

If they are domiciled in a state, they are also considered a resident of that state.

They may choose their domicile based on where they would like to live.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock