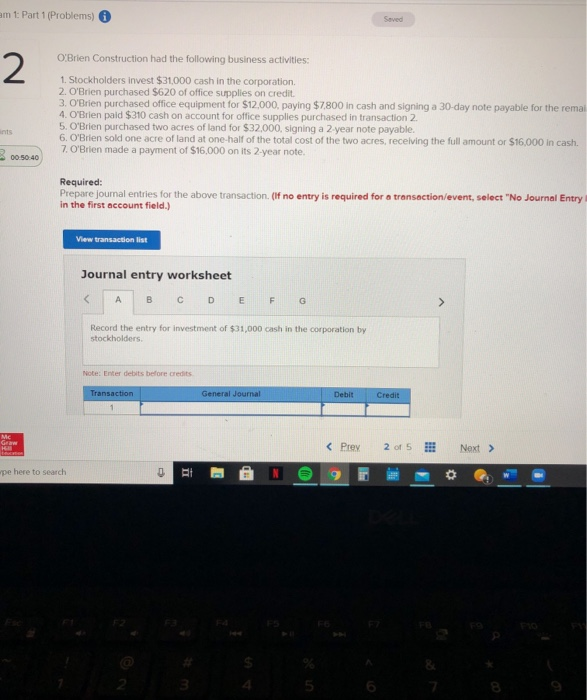

Question: amt: Part 1 (Problems) Saved 2 O'Brien Construction had the following business activities: 1. Stockholders invest $31,000 cash in the corporation. 2. O'Brien purchased $620

amt: Part 1 (Problems) Saved 2 O'Brien Construction had the following business activities: 1. Stockholders invest $31,000 cash in the corporation. 2. O'Brien purchased $620 of office supplies on credit. 3. O'Brien purchased office equipment for $12,000, paying $7.800 in cash and signing a 30-day note payable for the remai 4. O'Brien paid $310 cash on account for office supplies purchased in transaction 2 5. O'Brien purchased two acres of land for $32,000, signing a 2 year note payable. 6. O'Brien sold one acre of land at one-half of the total cost of the two acres, receiving the full amount or $16,000 in cash. 7. O'Brien made a payment of $16,000 on its 2-year note. ints 00:50:40 Required: Prepare journal entries for the above transaction. If no entry is required for a transaction/event, select "No Journal Entry in the first account field.) View transaction list Journal entry worksheet pe here to search 0 BH E HED 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts