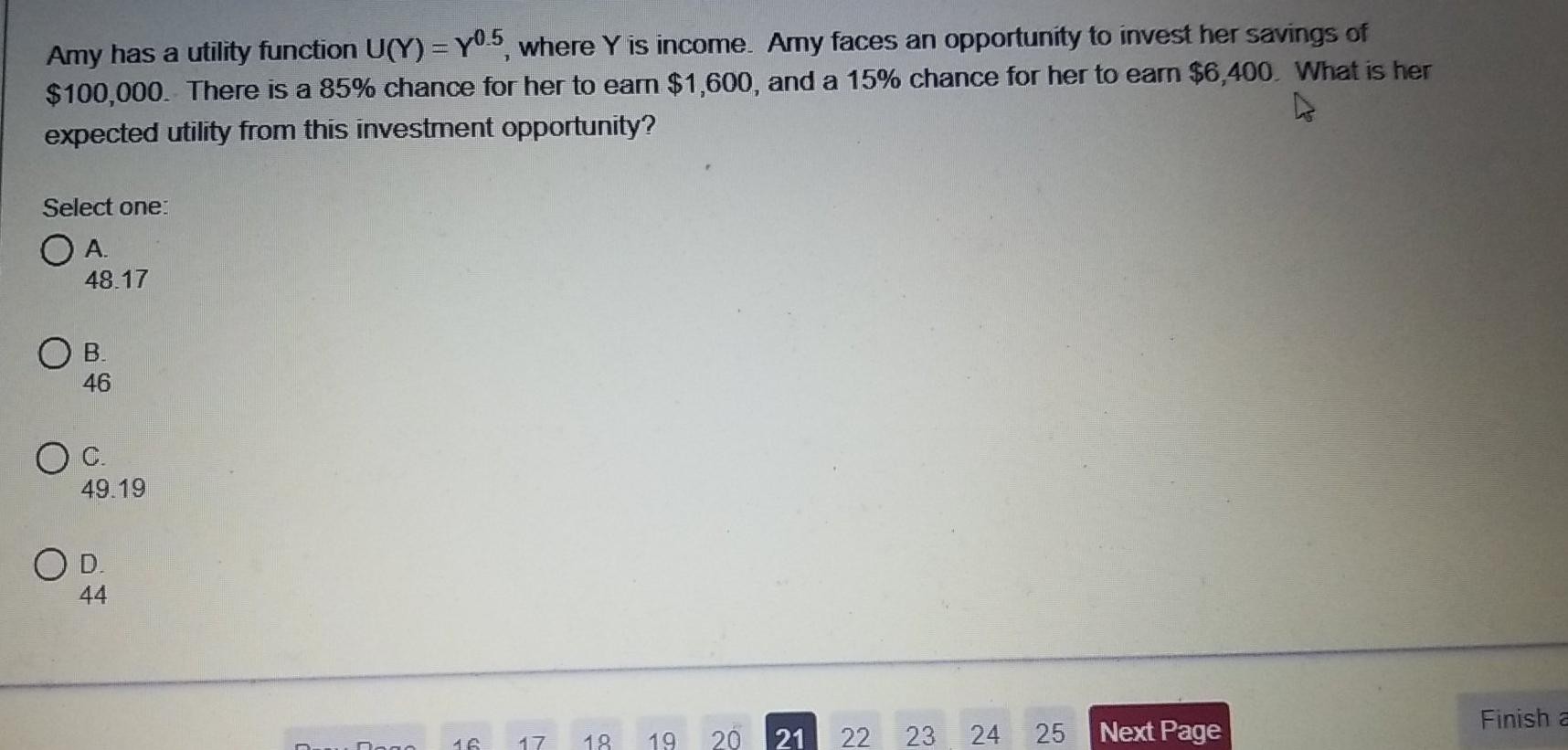

Question: Amy has a utility function U(Y) = y0.5, where Y is income. Amy faces an opportunity to invest her savings of $100,000. There is a

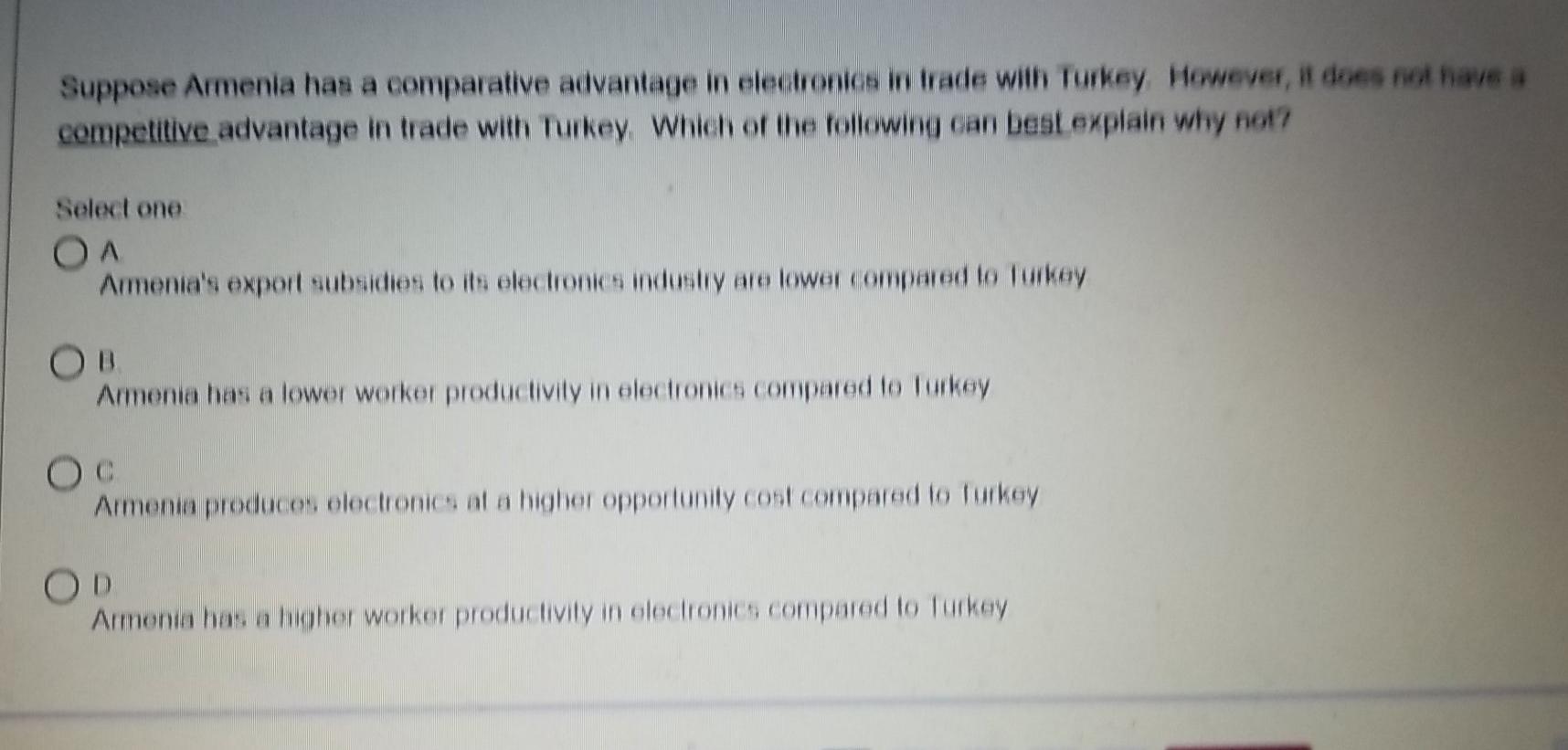

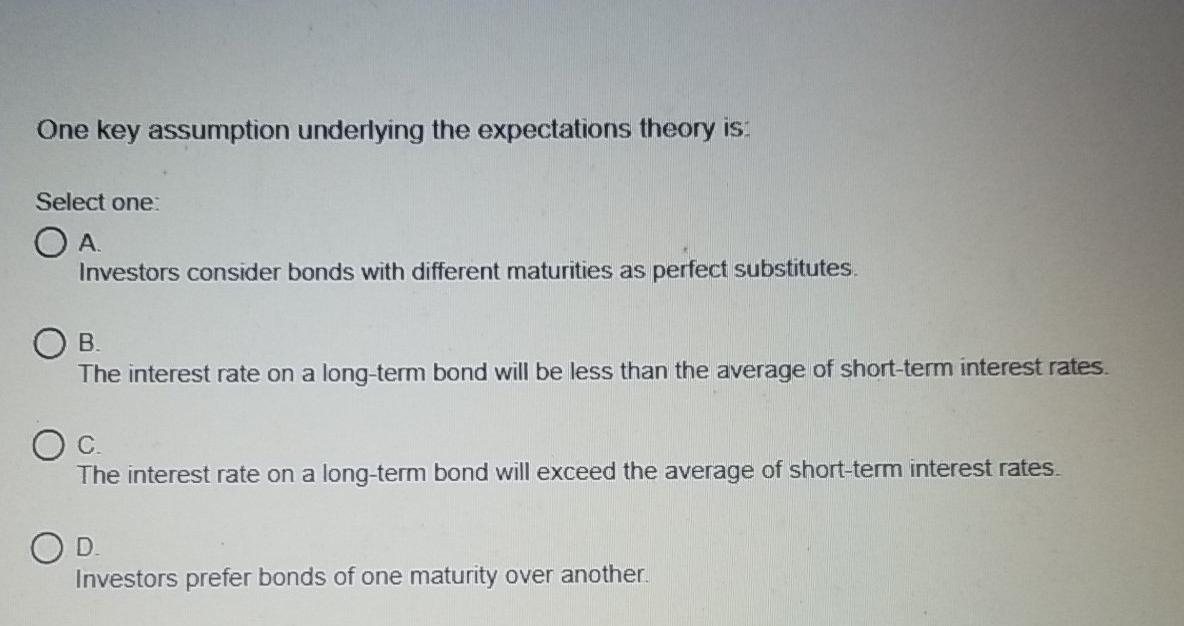

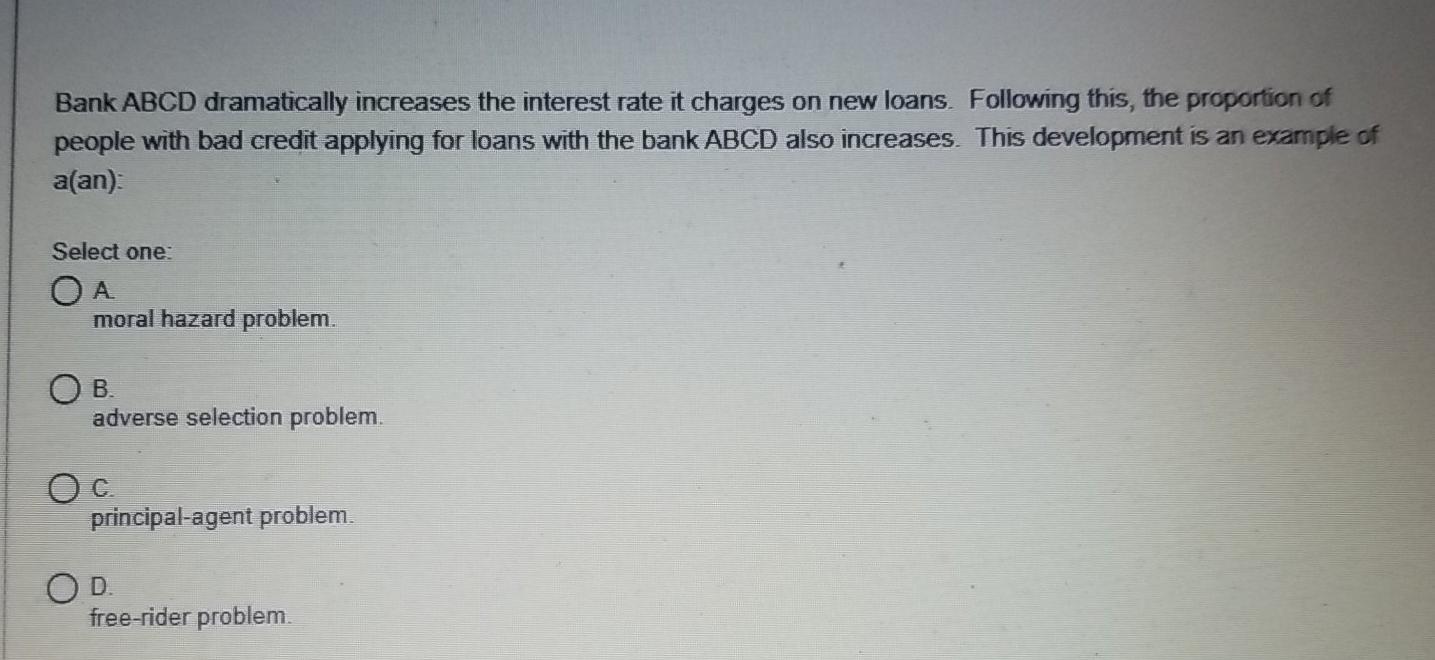

Amy has a utility function U(Y) = y0.5, where Y is income. Amy faces an opportunity to invest her savings of $100,000. There is a 85% chance for her to earn $1,600, and a 15% chance for her to earn $6,400. What is her expected utility from this investment opportunity? Select one: OA. . 48.17 . 46 Oc. 49.19 OD 44 Finish a 18 20 19 17 21 22 23 16 24 25 ago Next Page Suppose Armenia has a comparative advantage in electronics in trade with Turkey However, it does not have a competitive advantage in trade with Turkey. Which of the following can best explain why not? Select one On Armenia's export subsidies to its electronics industry are lower compared to Turkey Armenia has a lower worker productivity in electronics compared to turkey OC Armenia produces electronics at a higher opportunity cost compared to Turkey OD Armenia has a higher worker productivity in electronics compared to Turkey One key assumption underlying the expectations theory is. Select one: . Investors consider bonds with different maturities as perfect substitutes. . The interest rate on a long-term bond will be less than the average of short-term interest rates. Oc. The interest rate on a long-term bond will exceed the average of short-term interest rates D Investors prefer bonds of one maturity over another. Bank ABCD dramatically increases the interest rate it charges on new loans. Following this, the proportion of people with bad credit applying for loans with the bank ABCD also increases. This development is an example of a(an): Select one: moral hazard problem. . adverse selection problem. Oc. principal-agent problem. OD free-rider

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts