Question: Amy Summers Debt Management Assignment Using the information provided below and credit payoff tool Download credit payoff tool, identify a debt repayment plan to be

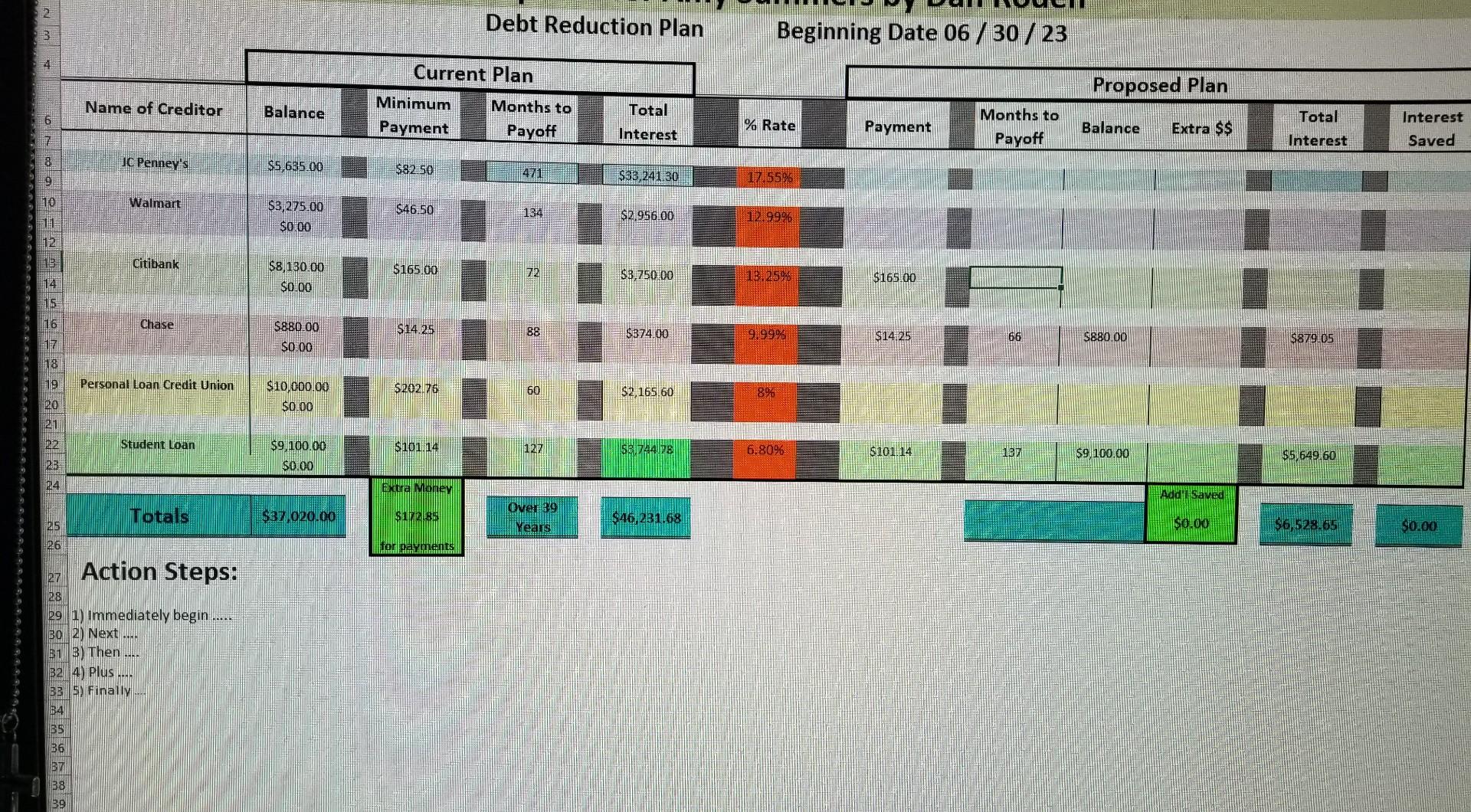

Amy Summers Debt Management Assignment Using the information provided below and credit payoff tool Download credit payoff tool, identify a debt repayment plan to be presented to Amy. The final plan should be entered in to the debt payoff template. Download debt payoff template with Action Steps for Amy to follow. Amy Summers has come to your office for advice regarding a debt repayment plan Amy is a single mom who recently completed nursing school Untortunately, she supported herself and her child largely through use of debt while she was attending school and could work only part time. Now that she has finished school, she is earning enough to live comfortably and can put some extra money toward paying off her debts instead of just payng the minimum payments each month as she has been doing over the past several years. Amy would like you to help her develop a repayment plan that will achieve two specific goals: 1) minimize the amount of interest paid, and 2) pay off her debts as quickly as possible. The following is a list of Any's current debts Amy believes that she can pay a to tal of $785 per month toward her debts. Give me a proposed plan to save Amy Money for the debt different than the Credit Card Repayment Calculator. JO Penny's credit card: Current balance is $5.635 Interest rate of 17.55% Minimum payment is $82.50 Debt Reduction Plan Beginning Date 06/30/23 Action Steps: 1) Immediately begin .... 2) Next. 3) Then 4) Plus. 5) Finaliy Amy Summers Debt Management Assignment Using the information provided below and credit payoff tool Download credit payoff tool, identify a debt repayment plan to be presented to Amy. The final plan should be entered in to the debt payoff template. Download debt payoff template with Action Steps for Amy to follow. Amy Summers has come to your office for advice regarding a debt repayment plan Amy is a single mom who recently completed nursing school Untortunately, she supported herself and her child largely through use of debt while she was attending school and could work only part time. Now that she has finished school, she is earning enough to live comfortably and can put some extra money toward paying off her debts instead of just payng the minimum payments each month as she has been doing over the past several years. Amy would like you to help her develop a repayment plan that will achieve two specific goals: 1) minimize the amount of interest paid, and 2) pay off her debts as quickly as possible. The following is a list of Any's current debts Amy believes that she can pay a to tal of $785 per month toward her debts. Give me a proposed plan to save Amy Money for the debt different than the Credit Card Repayment Calculator. JO Penny's credit card: Current balance is $5.635 Interest rate of 17.55% Minimum payment is $82.50 Debt Reduction Plan Beginning Date 06/30/23 Action Steps: 1) Immediately begin .... 2) Next. 3) Then 4) Plus. 5) Finaliy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts