Question: An actuarial problem on bonds that requires using: P=Fr(a angle n) + Cv^n no excel & show ALL steps please! Answer should be around $1095

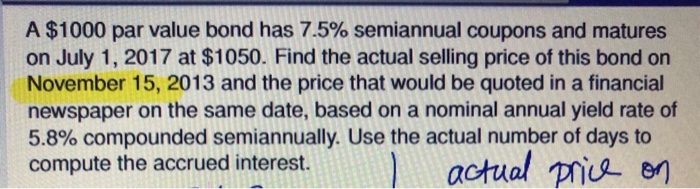

A $1000 par value bond has 7.5% semiannual coupons and matures on July 1, 2017 at $1050. Find the actual selling price of this bond on November 15, 2013 and the price that would be quoted in a financial newspaper on the same date, based on a nominal annual yield rate of 5.8% compounded semiannually. Use the actual number of days to compute the accrued interet. aotual en A $1000 par value bond has 7.5% semiannual coupons and matures on July 1, 2017 at $1050. Find the actual selling price of this bond on November 15, 2013 and the price that would be quoted in a financial newspaper on the same date, based on a nominal annual yield rate of 5.8% compounded semiannually. Use the actual number of days to compute the accrued interet. aotual en

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts