Question: An adjustable rate mortgage, or ARM, is a mortgage whose interest rate varies over the life of the loan. The interest rate is often tied

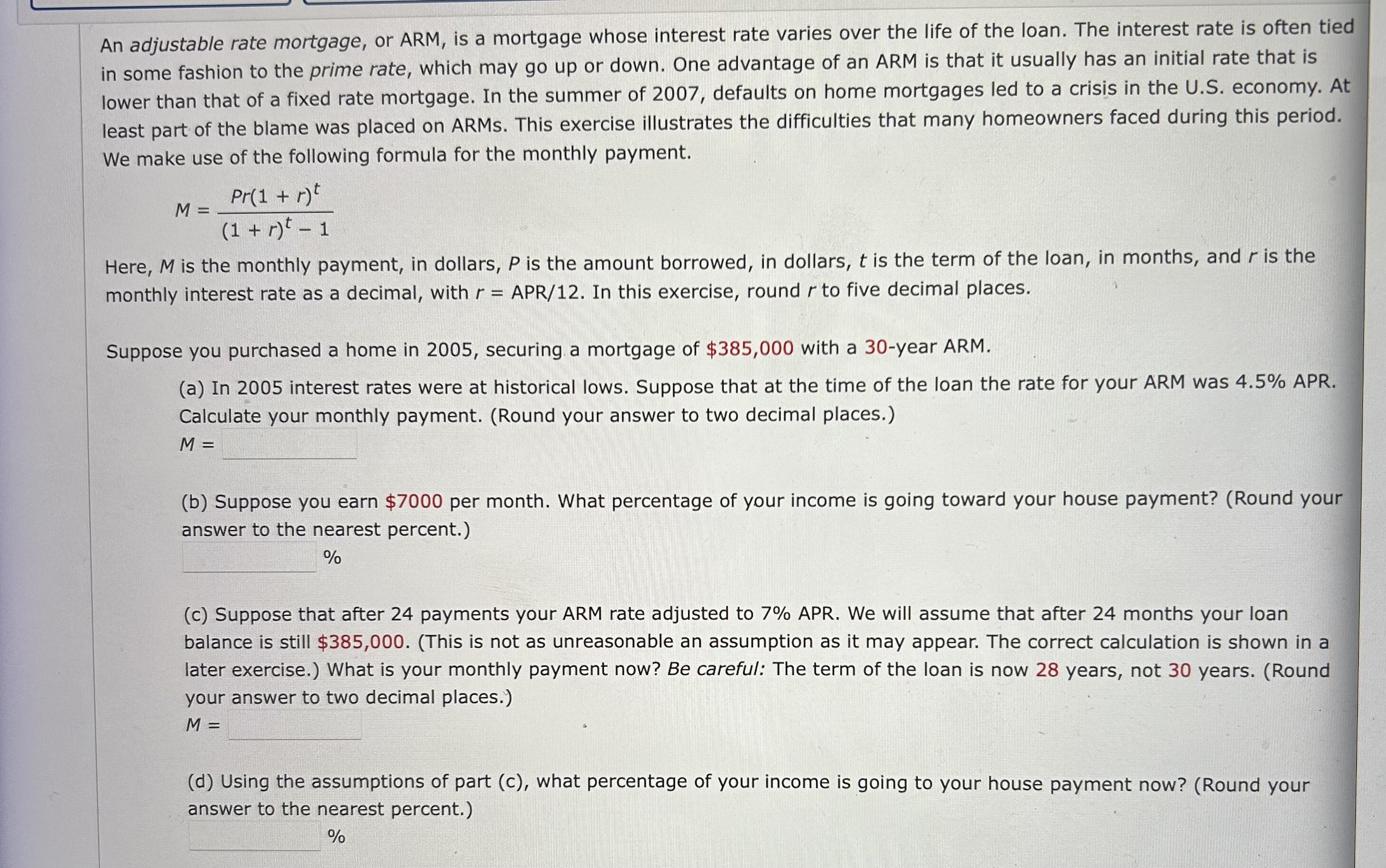

An adjustable rate mortgage, or ARM, is a mortgage whose interest rate varies over the life of the loan. The interest rate is often tied

in some fashion to the prime rate, which may go up or down. One advantage of an ARM is that it usually has an initial rate that is

lower than that of a fixed rate mortgage. In the summer of defaults on home mortgages led to a crisis in the US economy. At

least part of the blame was placed on ARMs. This exercise illustrates the difficulties that many homeowners faced during this period.

We make use of the following formula for the monthly payment.

Here, is the monthly payment, in dollars, is the amount borrowed, in dollars, is the term of the loan, in months, and is the

monthly interest rate as a decimal, with APR In this exercise, round to five decimal places.

Suppose you purchased a home in securing a mortgage of $ with a year ARM.

a In interest rates were at historical lows. Suppose that at the time of the loan the rate for your ARM was APR.

Calculate your monthly payment. Round your answer to two decimal places.

b Suppose you earn $ per month. What percentage of your income is going toward your house payment? Round your

answer to the nearest percent.

c Suppose that after payments your ARM rate adjusted to APR. We will assume that after months your loan

balance is still $This is not as unreasonable an assumption as it may appear. The correct calculation is shown in a

later exercise. What is your monthly payment now? Be careful: The term of the loan is now years, not years. Round

your answer to two decimal places.

d Using the assumptions of part c what percentage of your income is going to your house payment now? Round your

answer to the nearest percent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock