Question: An analysis of a proposal by the net present value method indicated that the present value exceeded the amount to be invested. Which of the

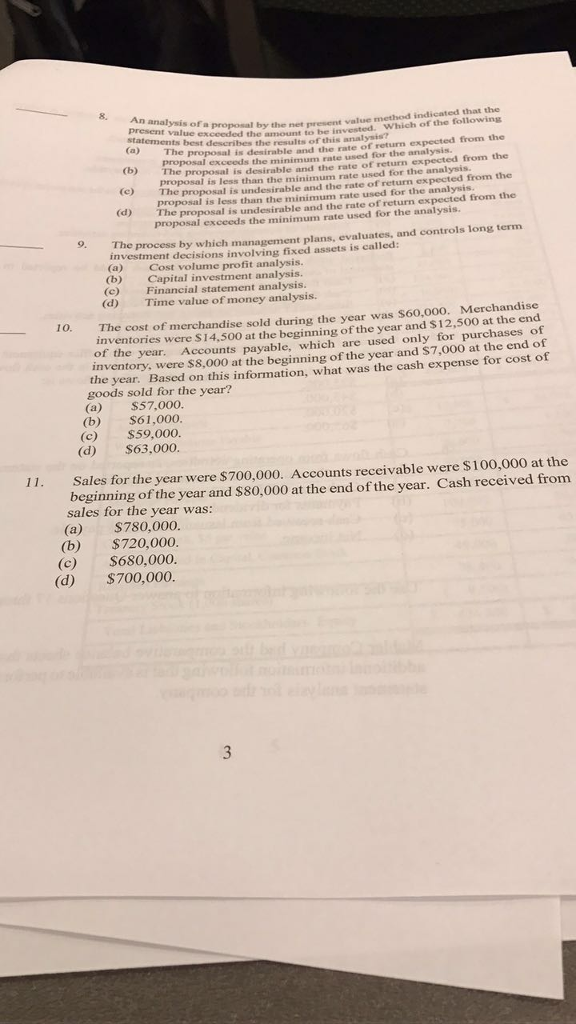

An analysis of a proposal by the net present value method indicated that the present value exceeded the amount to be invested. Which of the following statements best describes the result of this analysis? (a) The proposal is desirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis. (b) The proposal is desirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis. (c) The proposal is undesirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis. (d) The proposal is undesirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis? The process by which management plans, evaluates, and controls long term investment decisions involving fixed assets is called: (a) Cost volume profit analysis. (b) Capital investment analysis. (c) Financial statement analysis. (d) Time value of money analysis. The cost of merchandise sold during the year was $60,000. Merchandise inventories were $14, 500 at the beginning of the year and $12, 500 at the end of the year. Accounts payable, which are used only for purchases of inventory, were $8,000 at the beginning of the year and $7,000 at the end of the year. Based on this information, what was the cash expense for cost of goods sold for the year? (a) $57,000. (b) $61,000 (c) $59,000 (d) $63,000 Sales for the year were $700,000. Accounts receivable were $100,000 at the beginning of the year and $80,000 at the end of the year. Cash received from sales for the year was: (a) $780,000. (b) $720,000. (c) $680,000. (d) $700,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts