Question: An analyst approaches a valuation problem by first estimating the future cash flows attributable to an asset or project. If the analyst (incorrectly) determines the

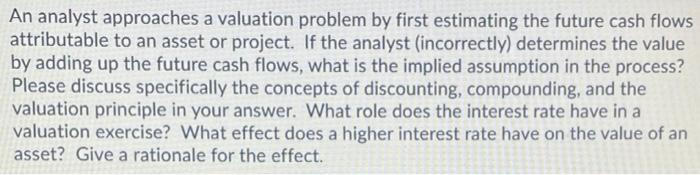

An analyst approaches a valuation problem by first estimating the future cash flows attributable to an asset or project. If the analyst (incorrectly) determines the value by adding up the future cash flows, what is the implied assumption in the process? Please discuss specifically the concepts of discounting, compounding, and the valuation principle in your answer. What role does the interest rate have in a valuation exercise? What effect does a higher interest rate have on the value of an asset? Give a rationale for the effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts