Question: An analyst considers different indices that could be constructed from stocks A, B, and C given the information below. In particular, the analyst considers all

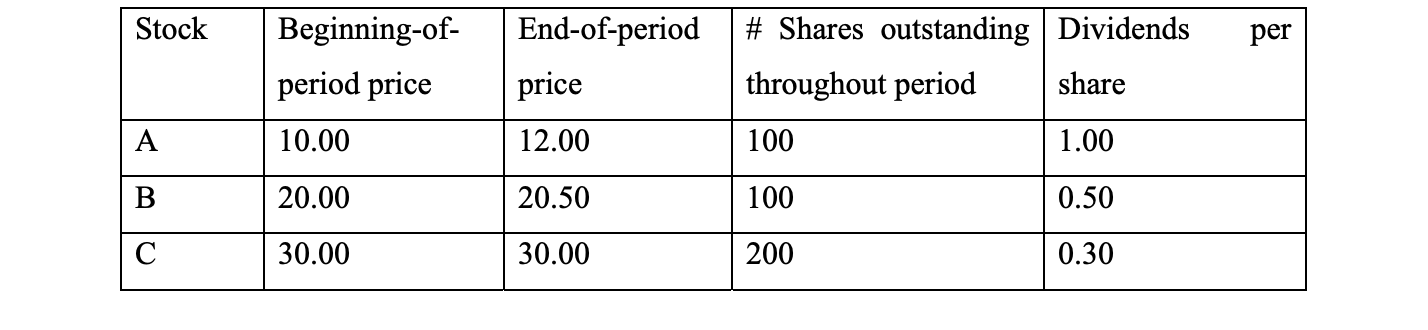

An analyst considers different indices that could be constructed from stocks A, B, and C given the information below. In particular, the analyst considers all 6 combinations given by the 3 different weighting methods (value-weighted, equally-weighted, and price-weighted) and the 2 different return definitions (price return, total return).

Which of the 6 indices would yield the highest return for the period? Which of the 6 indices would yield the lowest return?

Which of the 6 indices would yield the highest return for the period? Which of the 6 indices would yield the lowest return?

Stock per Beginning-of- period price End-of-period price # Shares outstanding Dividends throughout period share A 10.00 12.00 100 1.00 B 20.00 20.50 100 0.50 30.00 30.00 200 0.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts