Question: An analyst gathered information about the return distributions for two portfolios during the same time period. Based on the data, the analyst stated that the

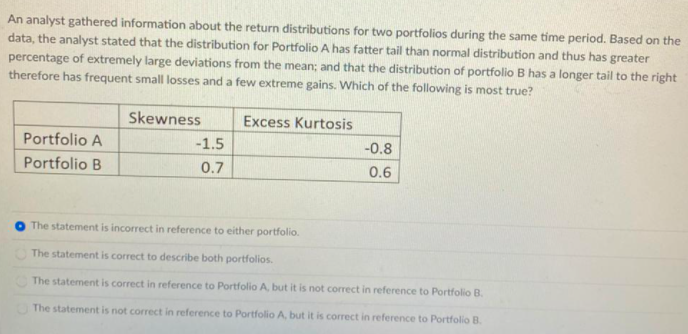

An analyst gathered information about the return distributions for two portfolios during the same time period. Based on the data, the analyst stated that the distribution for Portfolio A has fatter tail than normal distribution and thus has greater percentage of extremely large deviations from the mean; and that the distribution of portfolio B has a longer tail to the right therefore has frequent small losses and a few extreme gains. Which of the following is most true? Skewness Excess Kurtosis Portfolio A Portfolio B -1.5 0.7 -0.8 0.6 The statement is incorrect in reference to either portfolio The statement is correct to describe both portfolios The statement is correct in reference to Portfolio A, but it is not correct in reference to Portfolio B. The statement is not correct in reference to Portfolio A, but it is correct in reference to Portfolio B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts