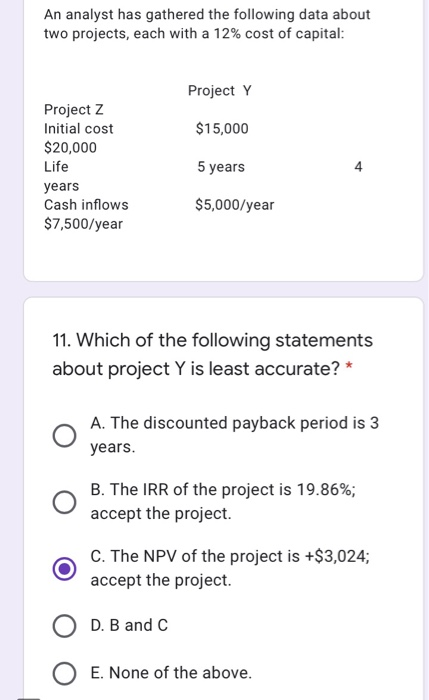

Question: An analyst has gathered the following data about two projects, each with a 12% cost of capital: Project Y $15,000 Project z Initial cost $20,000

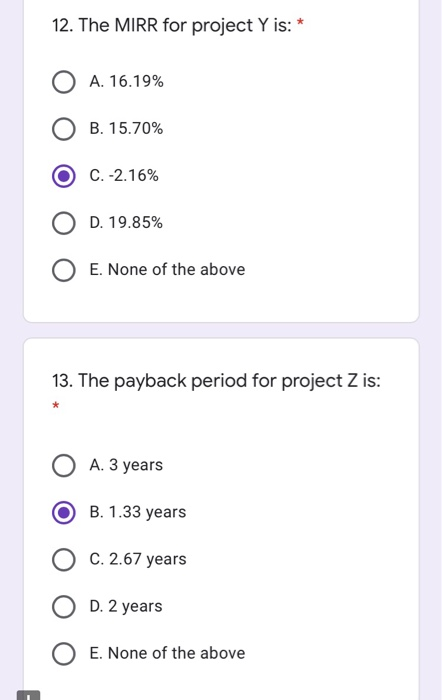

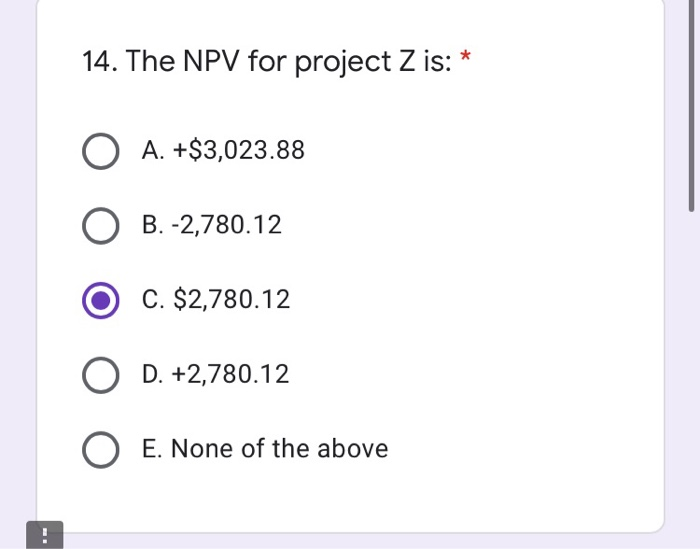

An analyst has gathered the following data about two projects, each with a 12% cost of capital: Project Y $15,000 Project z Initial cost $20,000 Life years Cash inflows $7,500/year 5 years $5,000/year 11. Which of the following statements about project Y is least accurate? * A. The discounted payback period is 3 years. B. The IRR of the project is 19.86%; accept the project. C. The NPV of the project is +$3,024; accept the project D. B and C E. None of the above. 12. The MIRR for project Y is: A. 16.19% B. 15.70% C.-2.16% D. 19.85% E. None of the above 13. The payback period for project Z is: A. 3 years B. 1.33 years C. 2.67 years D. 2 years E. None of the above 14. The NPV for project Z is: O A. +$3,023.88 O B. -2,780.12 C. $2,780.12 O D. +2,780.12 O E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts