Question: An analyst is estimating the required return on equity for a company and has gathered the following information: Estimated risk-free rate (10-year government bond)

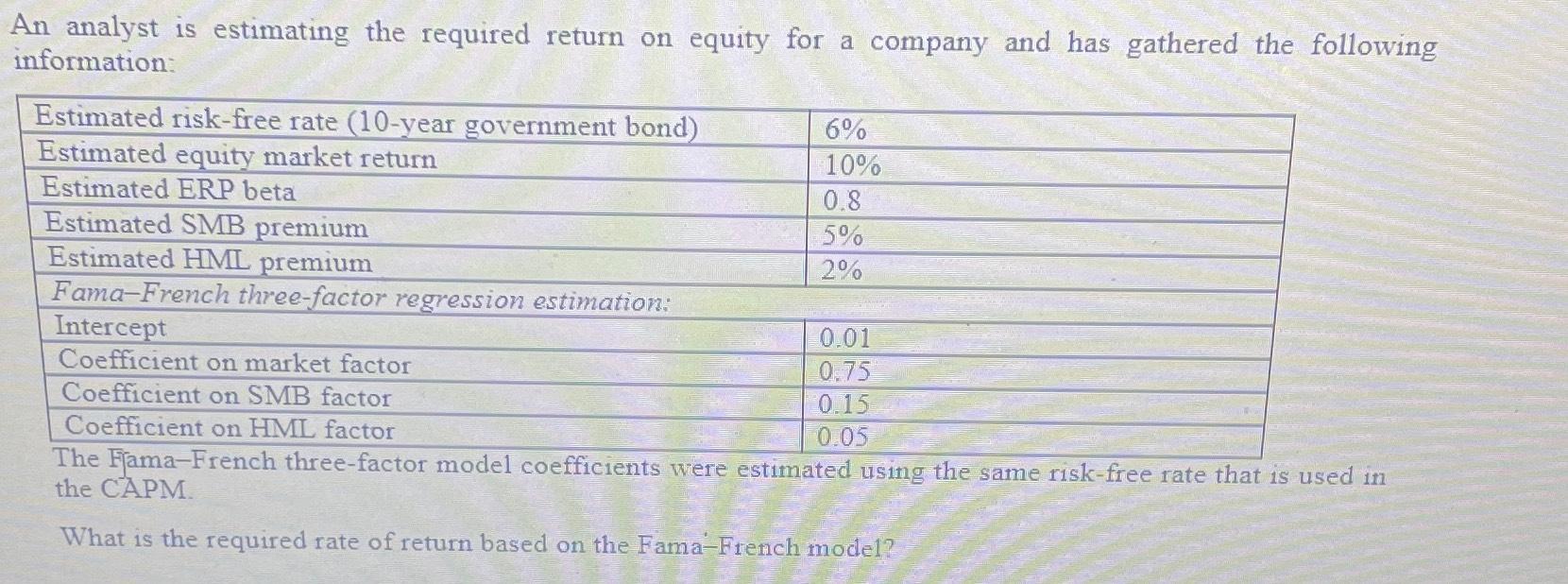

An analyst is estimating the required return on equity for a company and has gathered the following information: Estimated risk-free rate (10-year government bond) Estimated equity market return Estimated ERP beta Estimated SMB premium Estimated HML premium Fama-French three-factor regression estimation: 6% 10% 0.8 5% 2% Intercept Coefficient on market factor Coefficient on SMB factor Coefficient on HML factor The Fama-French three-factor model coefficients were estimated using the same risk-free rate that is used in the CAPM. What is the required rate of return based on the Fama-French model? 0.01 0.75 0.15 0.05

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

To calculate the required rate of return based on the FamaFrench threefactor mo... View full answer

Get step-by-step solutions from verified subject matter experts