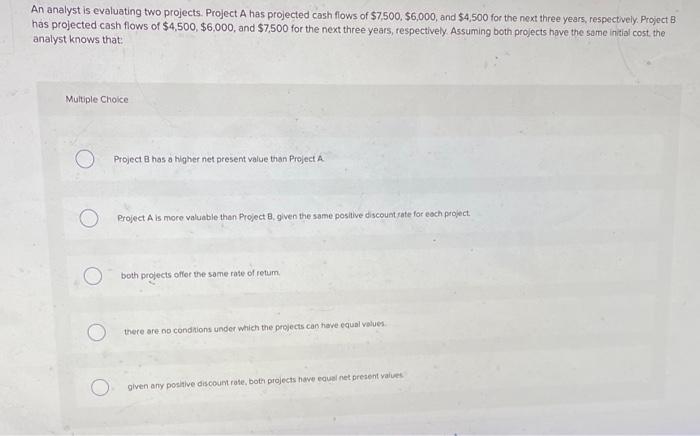

Question: An analyst is evaluating two projects. Project A has projected cash flows of $7,500,$6,000, and $4,500 for the next three years, respectively. Project B has

An analyst is evaluating two projects. Project A has projected cash flows of $7,500,$6,000, and $4,500 for the next three years, respectively. Project B has projected cash flows of $4,500,$6,000, and $7,500 for the next three years, respectively Assuming both projects have the same initial cost the analyst knows that: Multiple Choice Project in has a higher net present value than Project A. Project A is more valuable than Project B,9 iven the same positive discount rate for each project. both projects offer the same rate of retum. there are no condrions under which the projects can have equal values given any positive discount rate, both piojects have equei net present vaiues

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts