Question: An analyst is trying to determine the capital structure for Big Dawg Incorporated. After some careful research, the analyst knows the following: --Big Dawg

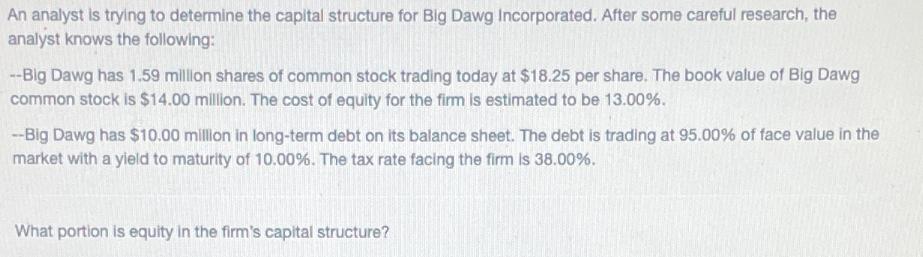

An analyst is trying to determine the capital structure for Big Dawg Incorporated. After some careful research, the analyst knows the following: --Big Dawg has 1.59 million shares of common stock trading today at $18.25 per share. The book value of Big Dawg common stock is $14.00 million. The cost of equity for the firm is estimated to be 13.00%. --Big Dawg has $10.00 million in long-term debt on its balance sheet. The debt is trading at 95.00% of face value in the market with a yield to maturity of 10.00%. The tax rate facing the firm is 38.00%. What portion is equity in the firm's capital structure?

Step by Step Solution

There are 3 Steps involved in it

To determine the portion of equity in Big Dawg Incorporateds capital structure we need to calculate ... View full answer

Get step-by-step solutions from verified subject matter experts