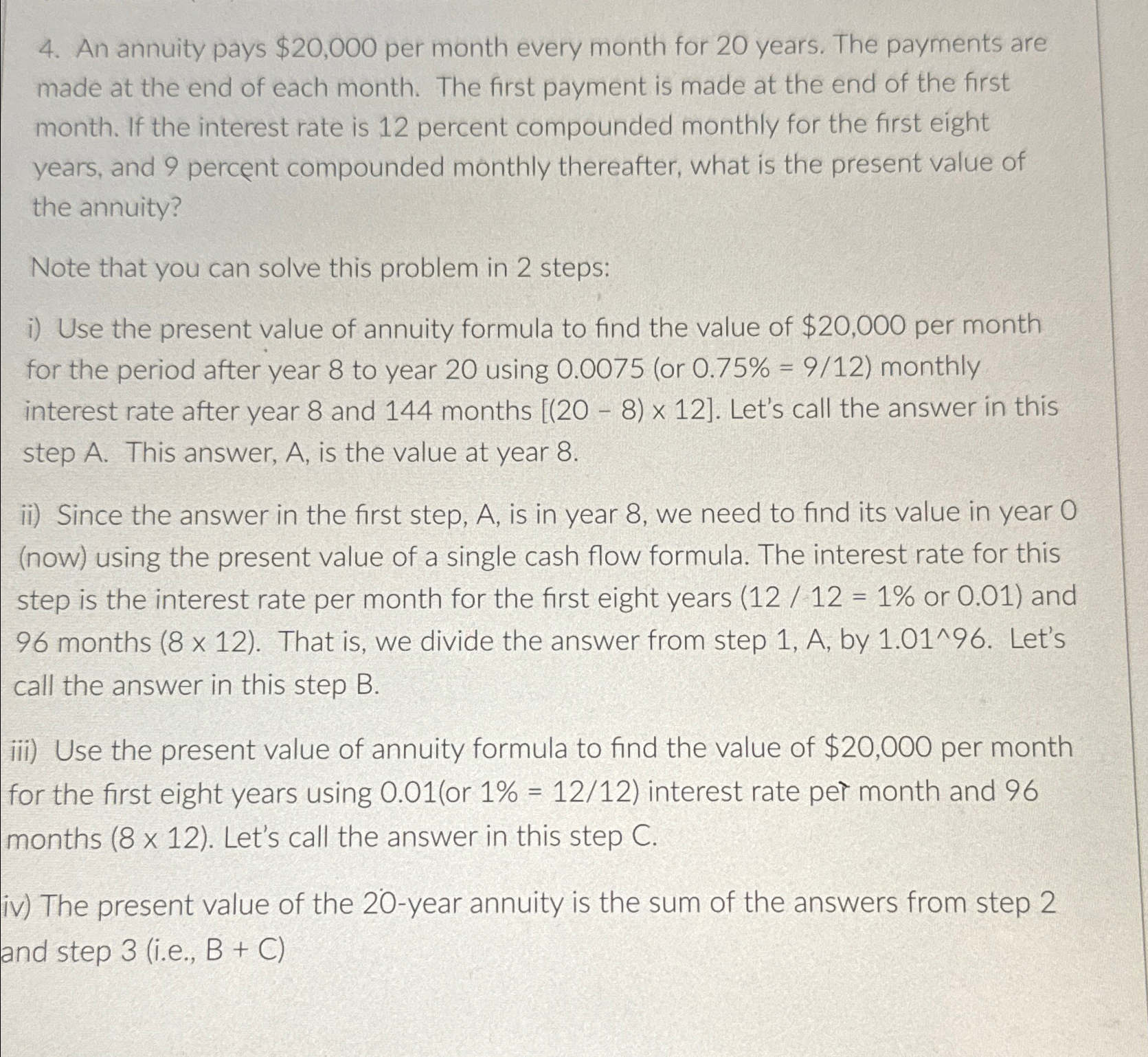

Question: An annuity pays $ 2 0 , 0 0 0 per month every month for 2 0 years. The payments are made at the end

An annuity pays $ per month every month for years. The payments are made at the end of each month. The first payment is made at the end of the first month. If the interest rate is percent compounded monthly for the first eight years, and percent compounded monthly thereafter, what is the present value of the annuity?

Note that you can solve this problem in steps:

i Use the present value of annuity formula to find the value of $ per month for the period after year to year using or monthly interest rate after year and months Let's call the answer in this step A This answer, A is the value at year

ii Since the answer in the first step, A is in year we need to find its value in year now using the present value of a single cash flow formula. The interest rate for this step is the interest rate per month for the first eight years or

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock