Question: An appraiser determines that a comparable property would have a holding period of 5 years, terminal cap rate (based on Yr 6 NOI) of

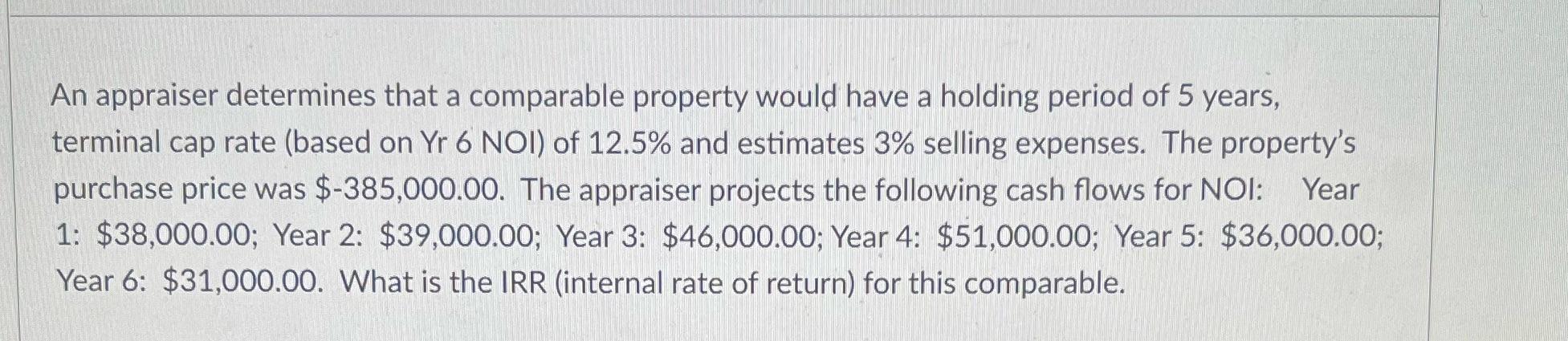

An appraiser determines that a comparable property would have a holding period of 5 years, terminal cap rate (based on Yr 6 NOI) of 12.5% and estimates 3% selling expenses. The property's purchase price was $-385,000.00. The appraiser projects the following cash flows for NOI: Year 1: $38,000.00; Year 2: $39,000.00; Year 3: $46,000.00; Year 4: $51,000.00; Year 5: $36,000.00; Year 6: $31,000.00. What is the IRR (internal rate of return) for this comparable.

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

The IRR for this comparable is 135 To calculate the IRR we can use the following formula IRR NPVIRR ... View full answer

Get step-by-step solutions from verified subject matter experts