Question: An appraiser must reconcile all methods and techniques both within each approach to value as well as to reconcile the different value indicators into a

An appraiser must reconcile all methods and techniques both within each approach to value as well as to reconcile the different value indicators into a final estimate of value. To reconcile different value indicators, the appraiser must give greatest weight to the indicator that is most RELEVANT to the appraisal problem at hand.

The process of reconciliation:

- Considers the most RELEVANT facts

- Determines how the MOST RELEVANT facts apply to the problem

- Reaches conclusions based on critical thinking

- Discloses the reasoning to the reader

Each sector of the commercial market, whether retail, office, industrial, hotel or apartments, generally sells at different cap rates based on the specific sectors risk and performance. This is further broken down within sectors by specific property types. In the case of retail, for example, an appraiser must consider the different risks and performance among (1) convenience centers (2) neighborhood (food and drug) centers, (3) Big Box retail, (4) outlet malls (5) specialty centers and (6) traditional regional centers.

In the case below, the appraiser is appraising an outlet center, but due to lack of recent outlet center sales over the past year is forced to include sales of two traditional retail centers. Note the appraisers detailed research as to how each retail submarket outperforms or underperforms the other and the appraisers market survey research of cap rates by property type through interviews with local retail brokers.

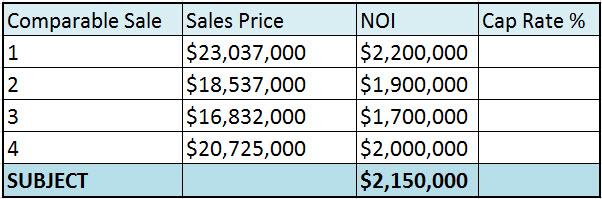

First, calculate the cap rate percent of each sale and be sure to round all cap rate percentages to two places to the right of the decimal point. Second, determine which sale is the most RELEVANT in terms of (a) retail type (risk) and (b) similar net operating income. Third, select the cap rate percentage of the most RELEVANT sale and reconcile to that cap rate.

I

Dewey Dewgood from the appraisal firm of Dewgood & Befayre is appraising the Shop Til You Drop Outlet Center in Anytown, USA and selects as comparables four recently sold retail center sales. Sales 2 and 3 are recent traditional center sales and Sales 1 and 4 are recent sales of outlet centers.

According to interviews with local retail brokers, cap rates are currently averaging in the mid-to-high 9.00% range for local outlet centers and in the low-to-mid 10.00% range for neighborhood retail centers. Additionally, local retail market research reports reflect that outlet center sales outperform traditional center sales.

The Shop Til You Drop Outlet Center has a current net operating income of $2,150,000.

What SINGLE cap rate percentage should Dewey reconcile to within the Income Approach as the most relevant to the subject property and WHY? (Please remember to express all cap rates as percentages and round all cap rate percentage calculations to two places to the right of the decimal point.) You may wish to use this Excel grid for faster calculation

Comparable Sale 1 12 3 Sales Price $23,037,000 $18,537,000 $16,832,000 $20,725,000 NOI Cap Rate % $2,200,000 $1,900,000 $1,700,000 $2,000,000 $2,150,000 4 SUBJECT Comparable Sale 1 12 3 Sales Price $23,037,000 $18,537,000 $16,832,000 $20,725,000 NOI Cap Rate % $2,200,000 $1,900,000 $1,700,000 $2,000,000 $2,150,000 4 SUBJECT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts