Question: An August 1 1 , 2 0 2 0 article from WorldOil Magazine had the following headline: Marathon Sets Up for $ 1 . 1

An August article from WorldOil Magazine had the following headline: "Marathon Sets Up for $ Billion Tax Refund via

Coronavirus Aid Law." The article goes on to indicate, "That measure included a tax provision that allows companies to immediately

deduct net operating losses and apply them to previous returns for five years from and instead of only applying

those deductions to future years. The benefit is supercharged because deductions taken before the tax overhaul can be claimed

at the corporate tax rate instead of the current

Marathon Petroleum Corporation's June Q states the following: As of June the estimated cash tax refund

resulting from the NOL carryback provided in the CARES Act is $ billion and arises solely due to taxes paid in prior years. Absent the

CARES Act, we would have recorded a deferred tax asset for the expected NOL carryforward under the currently effective federal

income tax rate."

Required:

Based only on the information provided above, prepare a journal entry that records the refund expected from applying the NOL

carryback.

Assuming a tax rate of in prior years, how much pretax net operating loss did Marathon carryback to prior periods to get the

refund indicated?

Assume now that the CARES Act was not in effect and Marathan is not eligible for any carryback. Prepare a journal entry that

records any tax expense benefit associated with creating a NOL carryforward, assuming a tax rate of for current and future

periods.

Whether Marathon could do an NOL carryback or an NOL carryforward, it would recover or avoid some taxes by utilizing the

NOL. How much extra tax did it recover or avoid due to the difference in tax rates between prior years and future years by being

able to use a carryback?

Complete this question by entering your answers in the tabs below.

Required

Required

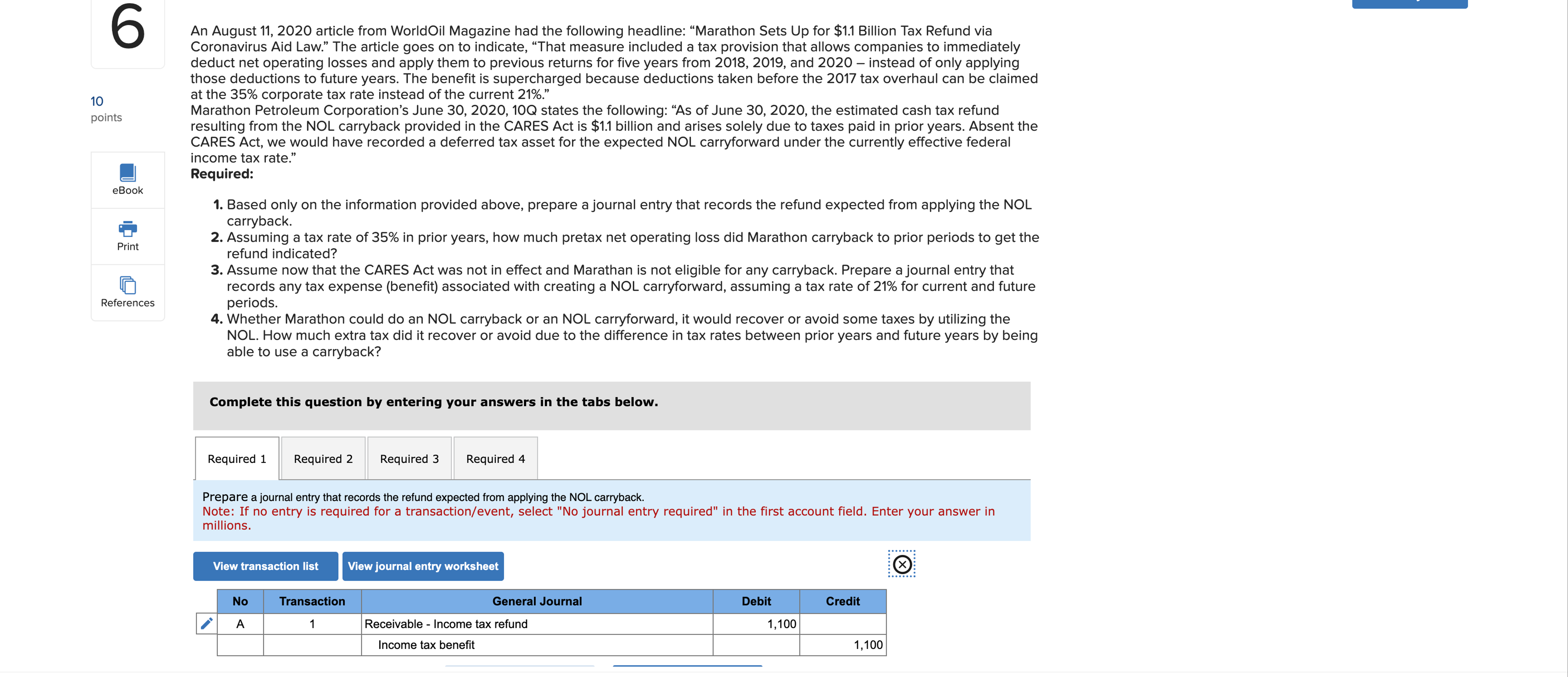

Prepare a journal entry that records the refund expected from applying the NOL carryback.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Enter your answer in

millions.

View journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock