Question: An automatic copier is being considered that will cost $8,000, have a life of four years, and no prospective salvage value at the end of

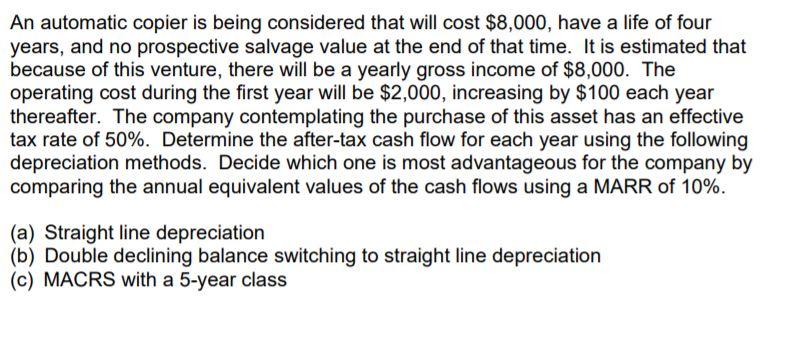

An automatic copier is being considered that will cost $8,000, have a life of four years, and no prospective salvage value at the end of that time. It is estimated that because of this venture, there will be a yearly gross income of $8,000. The operating cost during the first year will be $2,000, increasing by $100 each year thereafter. The company contemplating the purchase of this asset has an effective tax rate of 50%. Determine the after-tax cash flow for each year using the following depreciation methods. Decide which one is most advantageous for the company by comparing the annual equivalent values of the cash flows using a MARR of 10%. (a) Straight line depreciation (b) Double declining balance switching to straight line depreciation (c) MACRS with a 5-year class An automatic copier is being considered that will cost $8,000, have a life of four years, and no prospective salvage value at the end of that time. It is estimated that because of this venture, there will be a yearly gross income of $8,000. The operating cost during the first year will be $2,000, increasing by $100 each year thereafter. The company contemplating the purchase of this asset has an effective tax rate of 50%. Determine the after-tax cash flow for each year using the following depreciation methods. Decide which one is most advantageous for the company by comparing the annual equivalent values of the cash flows using a MARR of 10%. (a) Straight line depreciation (b) Double declining balance switching to straight line depreciation (c) MACRS with a 5-year class

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts