Question: An easier method of tracing the efficient frontier involves solving simultaneous equations of the form given below for unknown Zs for different assumed risk free

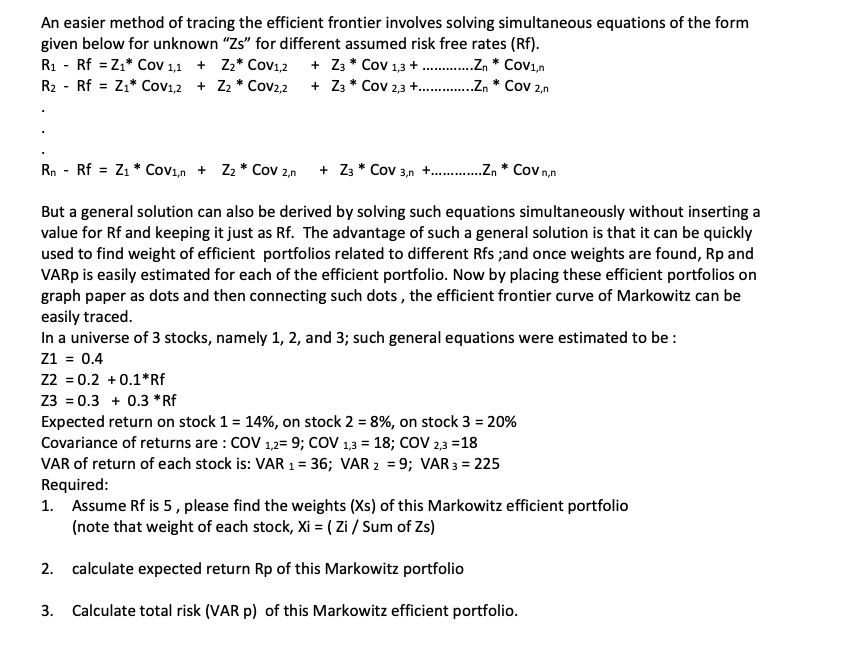

An easier method of tracing the efficient frontier involves solving simultaneous equations of the form given below for unknown "Zs" for different assumed risk free rates (Rf). R1 - Rf = Z1* COV 1,1 + Z2* COV1,2 + Z: * CoV 1,3 + ..Zn* Cov1,n R2 - Rf = Z1* COV1,2 + Z2 * COV2,2 + Z: * COV 2,3 +....... ...zn * Cov 2,0 Rn - Rf = Z1 * Cov1,n + Z2 * CoV 2,n + Z3 * Cov 3,n +...........Z. * Covn,n But a general solution can also be derived by solving such equations simultaneously without inserting a value for Rf and keeping it just as Rf. The advantage of such a general solution is that it can be quickly used to find weight of efficient portfolios related to different Rfs ;and once weights are found, Rp and VARp is easily estimated for each of the efficient portfolio. Now by placing these efficient portfolios on graph paper as dots and then connecting such dots, the efficient frontier curve of Markowitz can be easily traced. In a universe of 3 stocks, namely 1, 2, and 3; such general equations were estimated to be : 21 = 0.4 Z2 = 0.2 +0.1* Rf Z3 = 0.3 + 0.3 *Rf Expected return on stock 1 = 14%, on stock 2 = 8%, on stock 3 = 20% Covariance of returns are : COV 1,2= 9; COV 1,3 = 18; COV 2,3 =18 VAR of return of each stock is: VAR 1 = 36; VAR 2 = 9; VAR 3 = 225 Required: 1. Assume Rf is 5, please find the weights (Xs) of this Markowitz efficient portfolio (note that weight of each stock, Xi = ( Zi / Sum of Zs) 2. calculate expected return Rp of this Markowitz portfolio 3. Calculate total risk (VARp) of this Markowitz efficient portfolio. An easier method of tracing the efficient frontier involves solving simultaneous equations of the form given below for unknown "Zs" for different assumed risk free rates (Rf). R1 - Rf = Z1* COV 1,1 + Z2* COV1,2 + Z: * CoV 1,3 + ..Zn* Cov1,n R2 - Rf = Z1* COV1,2 + Z2 * COV2,2 + Z: * COV 2,3 +....... ...zn * Cov 2,0 Rn - Rf = Z1 * Cov1,n + Z2 * CoV 2,n + Z3 * Cov 3,n +...........Z. * Covn,n But a general solution can also be derived by solving such equations simultaneously without inserting a value for Rf and keeping it just as Rf. The advantage of such a general solution is that it can be quickly used to find weight of efficient portfolios related to different Rfs ;and once weights are found, Rp and VARp is easily estimated for each of the efficient portfolio. Now by placing these efficient portfolios on graph paper as dots and then connecting such dots, the efficient frontier curve of Markowitz can be easily traced. In a universe of 3 stocks, namely 1, 2, and 3; such general equations were estimated to be : 21 = 0.4 Z2 = 0.2 +0.1* Rf Z3 = 0.3 + 0.3 *Rf Expected return on stock 1 = 14%, on stock 2 = 8%, on stock 3 = 20% Covariance of returns are : COV 1,2= 9; COV 1,3 = 18; COV 2,3 =18 VAR of return of each stock is: VAR 1 = 36; VAR 2 = 9; VAR 3 = 225 Required: 1. Assume Rf is 5, please find the weights (Xs) of this Markowitz efficient portfolio (note that weight of each stock, Xi = ( Zi / Sum of Zs) 2. calculate expected return Rp of this Markowitz portfolio 3. Calculate total risk (VARp) of this Markowitz efficient portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts