Question: An electronics distributor sells a technology product with a very short lifecycle. The distributor orders the product from the manufacturer before observing demand and, due

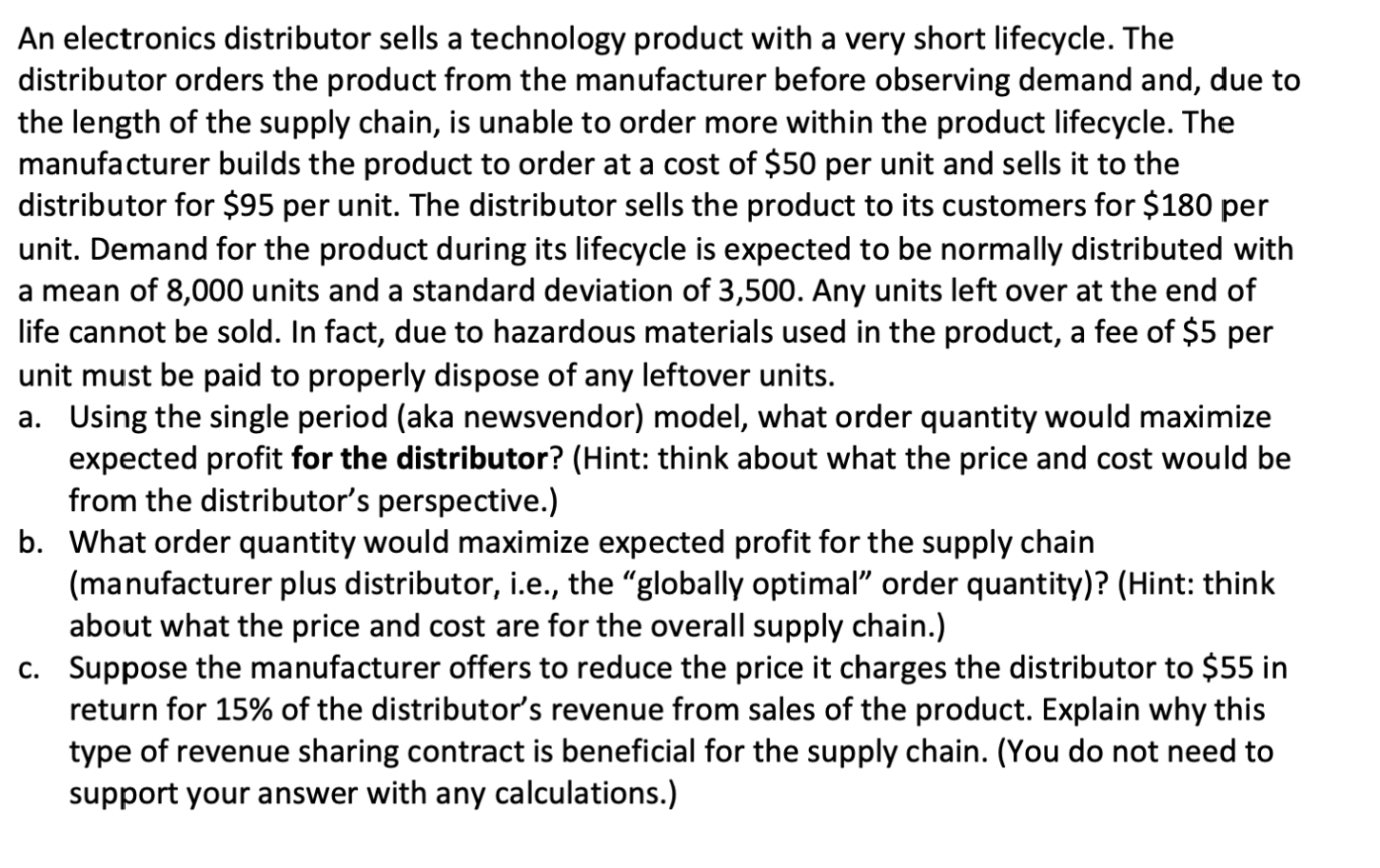

An electronics distributor sells a technology product with a very short lifecycle. The distributor orders the product from the manufacturer before observing demand and, due to the length of the supply chain, is unable to order more within the product lifecycle. The manufacturer builds the product to order at a cost of $50 per unit and sells it to the distributor for $95 per unit. The distributor sells the product to its customers for $180 per unit. Demand for the product during its lifecycle is expected to be normally distributed with a mean of 8,000 units and a standard deviation of 3,500. Any units left over at the end of life cannot be sold. In fact, due to hazardous materials used in the product, a fee of $5 per unit must be paid to properly dispose of any leftover units. a. Using the single period (aka newsvendor) model, what order quantity would maximize expected profit for the distributor? (Hint: think about what the price and cost would be from the distributor's perspective.) b. What order quantity would maximize expected profit for the supply chain (manufacturer plus distributor, i.e., the "globally optimal" order quantity)? (Hint: think about what the price and cost are for the overall supply chain.) c. Suppose the manufacturer offers to reduce the price it charges the distributor to \$55 in return for 15% of the distributor's revenue from sales of the product. Explain why this type of revenue sharing contract is beneficial for the supply chain. (You do not need to support your answer with any calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts