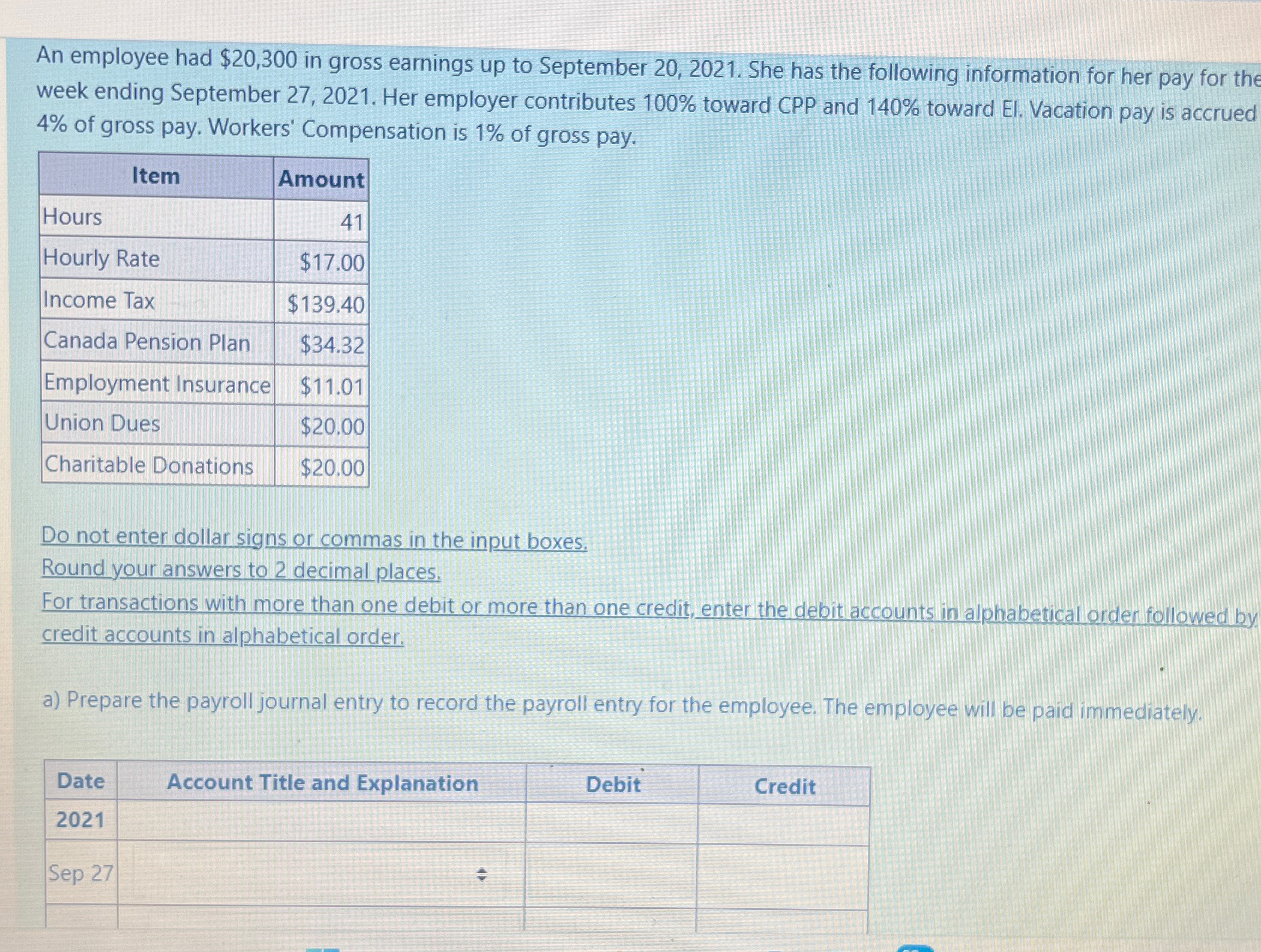

An employee had $20,300 in gross earnings up to September 20, 2021. She has the following...

Fantastic news! We've Found the answer you've been seeking!

Question:

Related Book For

Fundamental Accounting Principles

ISBN: 978-0078110870

20th Edition

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

Posted Date: