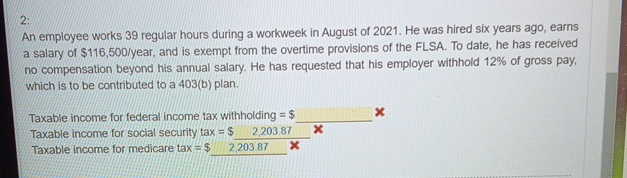

Question: An employee works 3 9 regular hours during a workweek in August of 2 0 2 1 . He was hired six years ago, earns

An employee works regular hours during a workweek in August of He was hired six years ago, earns a salary of $ year, and is exempt from the overtime provisions of the FLSA. To date, he has received no compensation beyond his annual salary. He has requested that his employer withhold of gross pay, which is to be contributed to a b plan.

Taxable income for federal income tax withholding $

Taxable income for social security tax

Taxable income for medicare tax $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock