Question: An engineer proposes a capital purchase for a new machine. The year zero purchase costs are estimated as $40K with an additional (one-time) investment of

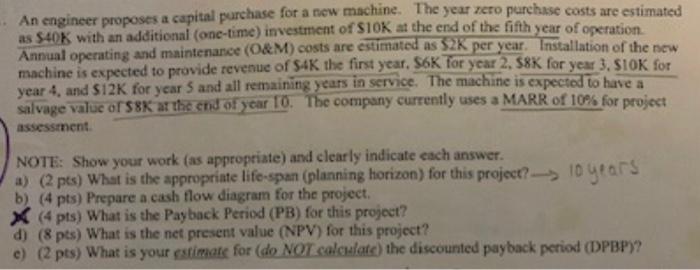

An engineer proposes a capital purchase for a new machine. The year zero purchase costs are estimated as $40K with an additional (one-time) investment of STOK at the end of the fifth year of operation Annual operating and maintenance (O&M) costs are estimated as $2K per year. Installation of the new machine is expected to provide revenue of S4K the first year, S6K for year 2, 58K for year 3. SIOK for year 4 and 512K for years and all remaining years in service. The machine is expected to have a salvage value of SK at the end of year 10. The company currently uses a MARR of 10% for project assessment NOTE: Show your work (as appropriate) and clearly indicate each answer. *) (2 pts) What is the appropriate life-span (planning horizon) for this project? --> 10 years b) (4 pts) Prepare a cash flow diagram for the project. X (4 pts) What is the Payback Period (PB) for this project? d) (8 pts) What is the net present value (NPV) for this project? e) (2 pts) What is your estimate for (do NOT calculate the discounted payback period (DPBP)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts