Question: An engineer team designed a thermal system that initially costs $240,000 for raw materials, installation and tune-up. Their corporation plans to implement the system for

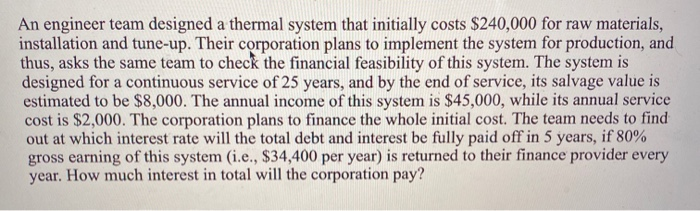

An engineer team designed a thermal system that initially costs $240,000 for raw materials, installation and tune-up. Their corporation plans to implement the system for production, and thus, asks the same team to check the financial feasibility of this system. The system is designed for a continuous service of 25 years, and by the end of service, its salvage value is estimated to be $8,000. The annual income of this system is $45,000, while its annual service cost is $2,000. The corporation plans to finance the whole initial cost. The team needs to find out at which interest rate will the total debt and interest be fully paid off in 5 years, if 80% gross earning of this system (i.e., $34,400 per year) is returned to their finance provider every year. How much interest in total will the corporation pay? An engineer team designed a thermal system that initially costs $240,000 for raw materials, installation and tune-up. Their corporation plans to implement the system for production, and thus, asks the same team to check the financial feasibility of this system. The system is designed for a continuous service of 25 years, and by the end of service, its salvage value is estimated to be $8,000. The annual income of this system is $45,000, while its annual service cost is $2,000. The corporation plans to finance the whole initial cost. The team needs to find out at which interest rate will the total debt and interest be fully paid off in 5 years, if 80% gross earning of this system (i.e., $34,400 per year) is returned to their finance provider every year. How much interest in total will the corporation pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts