Question: An entity has no permanent differences or state income taxes. The federal tax rate in 20X4 and all prior years was 40%. In early

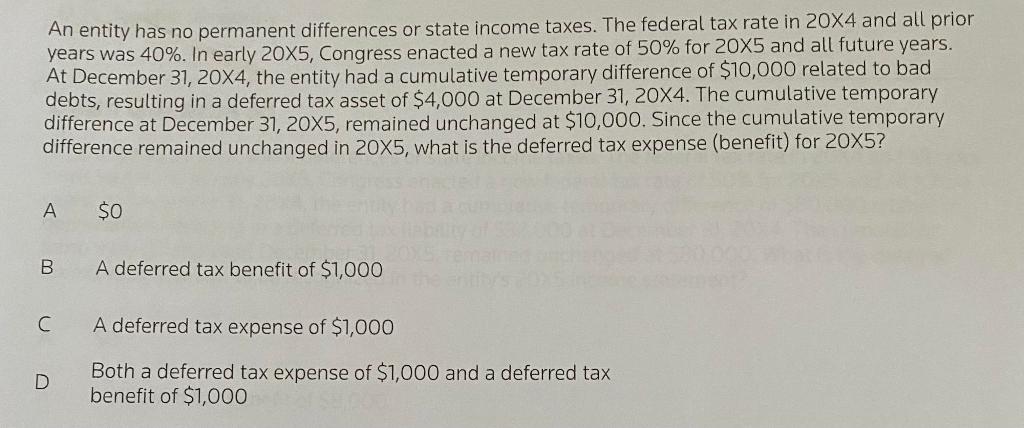

An entity has no permanent differences or state income taxes. The federal tax rate in 20X4 and all prior years was 40%. In early 20X5, Congress enacted a new tax rate of 50% for 20X5 and all future years. At December 31, 20X4, the entity had a cumulative temporary difference of $10,000 related to bad debts, resulting in a deferred tax asset of $4,000 at December 31, 20X4. The cumulative temporary difference at December 31, 20X5, remained unchanged at $10,000. Since the cumulative temporary difference remained unchanged in 20X5, what is the deferred tax expense (benefit) for 20X5? A $0 A deferred tax benefit of $1,000 A deferred tax expense of $1,000 Both a deferred tax expense of $1,000 and a deferred tax benefit of $1,000

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

umulative temporary difference at December 3120... View full answer

Get step-by-step solutions from verified subject matter experts