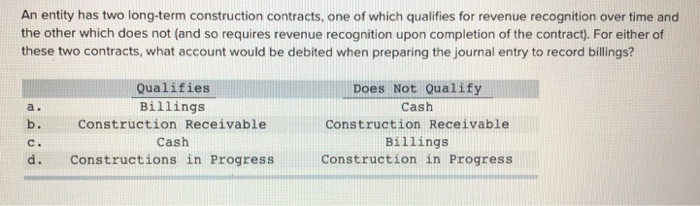

Question: An entity has two long-term construction contracts, one of which qualifies for revenue recognition over time and the other which does not (and so requires

An entity has two long-term construction contracts, one of which qualifies for revenue recognition over time and the other which does not (and so requires revenue recognition upon completion of the contract). For either of these two contracts, what account would be debited when preparing the journal entry to record billings? Does Not Qualify Qualifies Billings Cash a. b. Construction Receivable Construction Receivable Billings Construction in Progress Cash C. Constructions in Progress d. Multiple Choice Option a Option c Option b Option d

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock