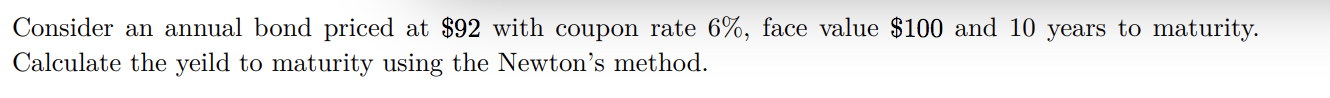

Question: an example of Newton's method is provided Consider an annual bond priced at $92 with coupon rate 6%, face value $100 and 10 years to

an example of Newton's method is provided

an example of Newton's method is provided

Consider an annual bond priced at $92 with coupon rate 6%, face value $100 and 10 years to maturity. Calculate the yeild to maturity using the Newton's method. Example 8.9. Consider an annual bond priced at $88 with coupon rate 5%, face value $100, and 5 years to maturity. Calculate the yield to maturity using Newton's method. (- + = 5 1 100 f(xk) = 88 1 ek (1 + xk)5 (1 + xk)5? 5 1 25 500 f'(xk) 1 + x 2 (1 + xk)5 X* (1 + xk) (1 + xk)6? f(x) k+1 = Ik - f'(xk) ( - ) = 10-10 We set ftol 9, 1to1 = 10-9. Table 8.3 shows the convergence of 2k to the value of 0.08005949 within 4 steps for different initial values zo = 0.06, 0.04, and 0.1. Table 8.3. Numerical calculation of the yield to maturity using Newton's method. k 0 1 2 3 4 5 0.06 0.07900457 0.080056507 0.080059487 0.080059487 0.080059487 k+1 0.07900457 0.080056507 0.080059487 0.080059487 0.080059487 0.080059487 f(xk) -7.787636214 -0.388869656 -0.001095479 -8.75312E-09 0 0 f'(XX+1) 409.7770272 369.6702427 367.5897806 367.5839064 367.5839063 367.5839063 0 1 2 3 4 5 0.04 0.075945459 0.080014316 0.080059481 0.080059487 0.080059487 0.075945459 0.080014316 0.080059481 0.080059487 0.080059487 0.080059487 - 16.45182233 -1.529077742 -0.016606054 -2.0108E-06 0 0 457.6884757 375.8003071 367.6729547 367.5839171 367.5839063 367.5839063 0 1 2 0.1 0.078969396 0.080056305 0.080059487 0.080059487 0.080059487 0.078969396 0.080056305 0.080059487 0.080059487 0.080059487 0.080059487 6.953933847 -0.401873853 -0.001169706 -9.97946E-09 0 0 330.657821 369.7400501 367.5901786 367.5839064 367.5839063 367.5839063 3 4 5 Consider an annual bond priced at $92 with coupon rate 6%, face value $100 and 10 years to maturity. Calculate the yeild to maturity using the Newton's method. Example 8.9. Consider an annual bond priced at $88 with coupon rate 5%, face value $100, and 5 years to maturity. Calculate the yield to maturity using Newton's method. (- + = 5 1 100 f(xk) = 88 1 ek (1 + xk)5 (1 + xk)5? 5 1 25 500 f'(xk) 1 + x 2 (1 + xk)5 X* (1 + xk) (1 + xk)6? f(x) k+1 = Ik - f'(xk) ( - ) = 10-10 We set ftol 9, 1to1 = 10-9. Table 8.3 shows the convergence of 2k to the value of 0.08005949 within 4 steps for different initial values zo = 0.06, 0.04, and 0.1. Table 8.3. Numerical calculation of the yield to maturity using Newton's method. k 0 1 2 3 4 5 0.06 0.07900457 0.080056507 0.080059487 0.080059487 0.080059487 k+1 0.07900457 0.080056507 0.080059487 0.080059487 0.080059487 0.080059487 f(xk) -7.787636214 -0.388869656 -0.001095479 -8.75312E-09 0 0 f'(XX+1) 409.7770272 369.6702427 367.5897806 367.5839064 367.5839063 367.5839063 0 1 2 3 4 5 0.04 0.075945459 0.080014316 0.080059481 0.080059487 0.080059487 0.075945459 0.080014316 0.080059481 0.080059487 0.080059487 0.080059487 - 16.45182233 -1.529077742 -0.016606054 -2.0108E-06 0 0 457.6884757 375.8003071 367.6729547 367.5839171 367.5839063 367.5839063 0 1 2 0.1 0.078969396 0.080056305 0.080059487 0.080059487 0.080059487 0.078969396 0.080056305 0.080059487 0.080059487 0.080059487 0.080059487 6.953933847 -0.401873853 -0.001169706 -9.97946E-09 0 0 330.657821 369.7400501 367.5901786 367.5839064 367.5839063 367.5839063 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts