Question: An Excel model based on the FinCorp example discussed in the text is shown below. The model allows you to use any variety of options,

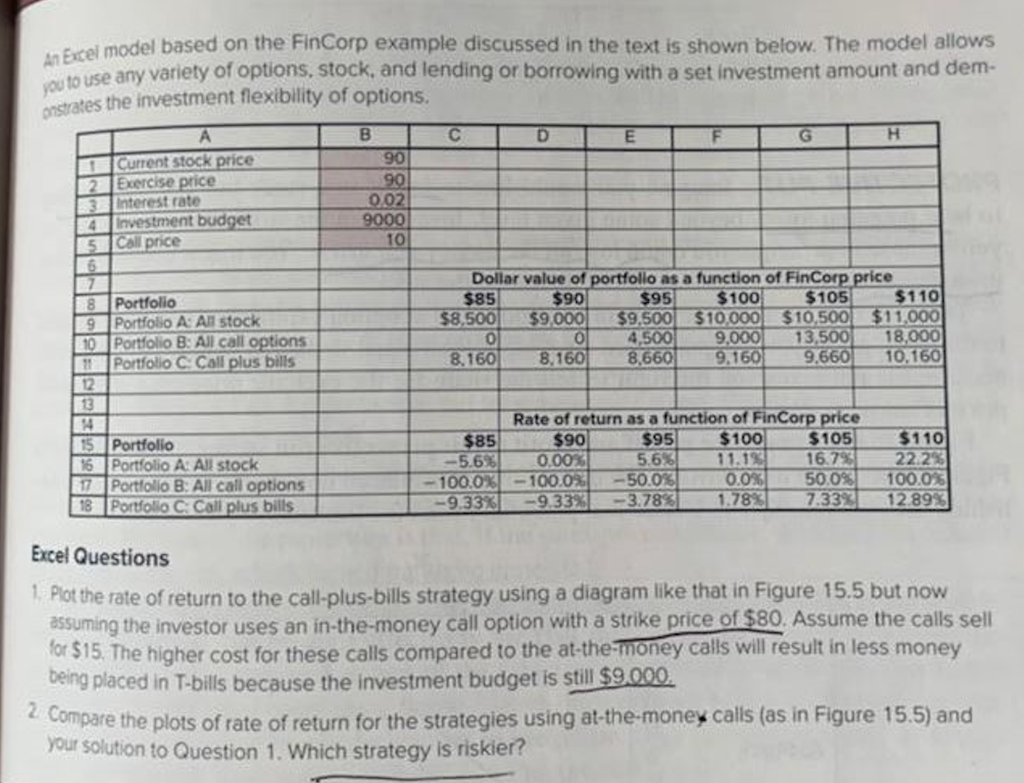

An Excel model based on the FinCorp example discussed in the text is shown below. The model allows you to use any variety of options, stock, and lending or borrowing with a set investment amount and demmentates the investment flexibility of options. Excel Questions 1. Plot the rate of return to the call-plus-bills strategy using a diagram like that in Figure 15.5 but now assuming the investor uses an in-the-money call option with a strike price of $80. Assume the calls sell for \$15. The higher cost for these calls compared to the at-the-money calls will result in less money being placed in T-bills because the investment budget is still$9.000. 2 Compare the plots of rate of return for the strategies using at-the-money calls (as in Figure 15.5) and your solution to Question 1. Which strategy is riskier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts