Question: An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a

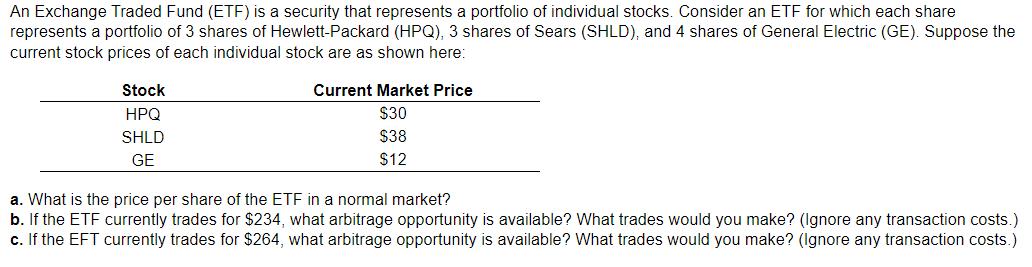

An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of 3 shares of Hewlett-Packard (HPQ), 3 shares of Sears (SHLD), and 4 shares of General Electric (GE). Suppose the current stock prices of each individual stock are as shown here: Stock HPQ SHLD GE Current Market Price $30 $38 $12 a. What is the price per share of the ETF in a normal market? b. If the ETF currently trades for $234, what arbitrage opportunity is available? What trades would you make? (Ignore any transaction costs.) c. If the EFT currently trades for $264, what arbitrage opportunity is available? What trades would you make? (Ignore any transaction costs.)

Step by Step Solution

There are 3 Steps involved in it

ETF Pricing and Arbitrage Opportunities a Normal Market Price To find the price per share of the ETF ... View full answer

Get step-by-step solutions from verified subject matter experts