Question: An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio

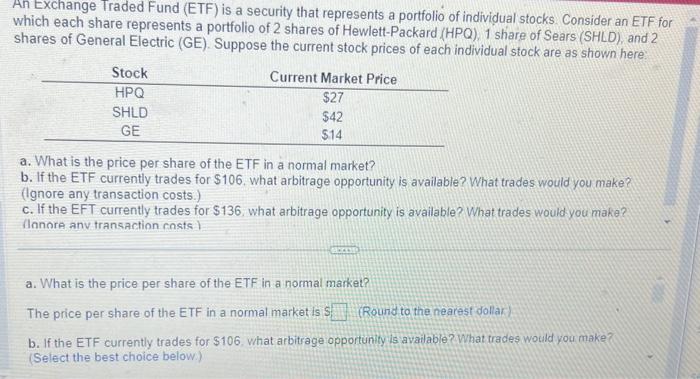

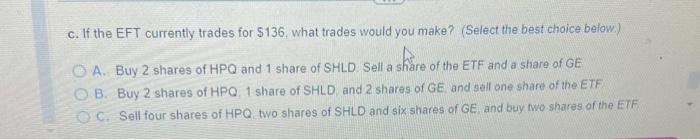

An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of 2 shares of Hewlett-Packard (HPQ), 1 share of Sears (SHLD), and 2 shares of General Electric (GE). Suppose the current stock prices of each individual stock are as shown here. a. What is the price per share of the ETF in a normal market? b. If the ETF currently trades for $106. what arbitrage opportunity is available? What trades would you make? (Ignore any transaction costs.) c. If the EFT currently trades for $136, what arbitrage opportunity is available? What trades would you make? (Innore anv transaction rnsts) a. What is the price per share of the ETF in a normal market? The price per share of the ETF in a normal market is \$ (Round to the nearest dollar) b. If the ETF currently trades for $106, what arbitrage opportunity is available? What trades would you make? (Select the best choice below.) C. If the EFT currently trades for $136, what trades would you make? (Select the best choice befow.) A. Buy 2 shares of HPQ and 1 share of SHLD. Sell a share of the ETF and a share of GE B. Buy 2 shares of HPQ.1 share of SHLD and 2 shares of GE and sell one share of the ETF C. Sell four shares of HPQ. two shares of SHLD and six shares of GE and buy two shares of the EIF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts