Question: (AN EXTREMELY IMPORTANT QUESTION, MAKE SURE YOU UNDERSTAND EVERY STEP You are part of a team of analysts working on the valuation of Solo Inc.

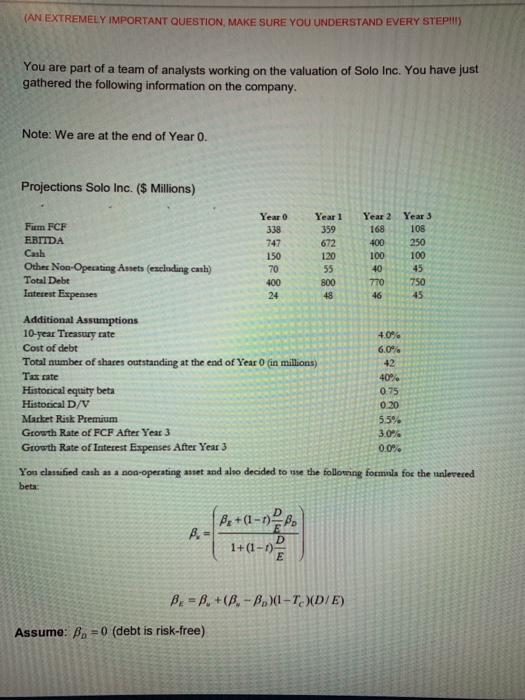

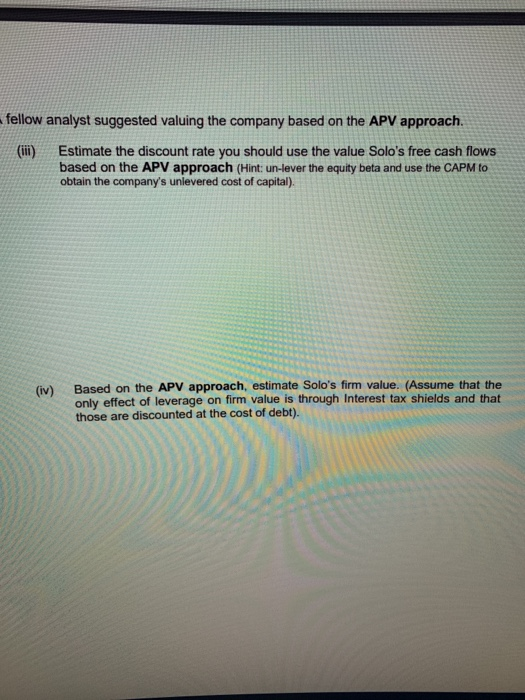

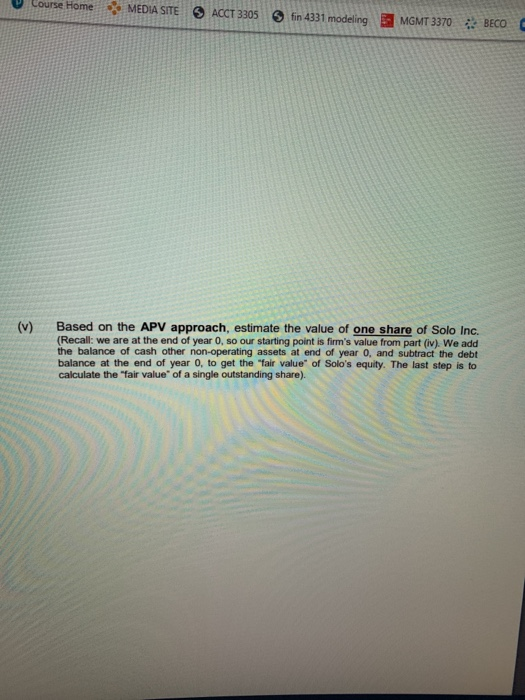

(AN EXTREMELY IMPORTANT QUESTION, MAKE SURE YOU UNDERSTAND EVERY STEP You are part of a team of analysts working on the valuation of Solo Inc. You have just gathered the following information on the company. Note: We are at the end of Year 0. Projections Solo Inc. ($ Millions) Year o Year 1 Year 2 Year 3 338 9 Furm FCF EBITDA Cash Other Non-Operating Assets (excluding cash) Total Debt Interest Expenses 150 120 100 40 70 400 800 ta 4.06 Additional Assumptions 10-year Treasury cate Cost of debt Total number of shares outstanding at the end of Year 0 (in millions Taste Historical equity beta Historical D/V Market Risk Premium Growth Rate of FCF After Year 3 Growth Rate of Interest Expenses After Year 3 6.0% 42 40% 0.75 0.20 5.5% 3.0 Yon classified cash as a non-operating asset and also decided to use the following formula for the unlevered beta: B. = B. +0.- B.-T.)(D/E) Assume: Bo = 0 (debt is risk-free) fellow analyst suggested valuing the company based on the APV approach. (i) Estimate the discount rate you should use the value Solo's free cash flows based on the APV approach (Hint: un-lever the equity beta and use the CAPM to obtain the company's unlevered cost of capital). (iv) Based on the APV approach, estimate Solo's firm value. (Assume that the only effect of leverage on firm value is through Interest tax shields and that those are discounted at the cost of debt). Home M EDIA SITE ACCT 33053 fin 4331 modeling MGMT 33702 BECO (v) Based on the APV approach, estimate the value of one share of Solo Inc. (Recall: we are at the end of year 0, so our starting point is firm's value from part (iv). We add the balance of cash other non-operating assets at end of year 0, and subtract the debt balance at the end of year o, to get the "fair value of Solo's equity. The last step is to calculate the "fair value of a single outstanding share)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts