Question: an IDHS: C X & IDHS: | X M . jgN) X (PDE 512 tes X M Inbox ( X Bb *A date X COXM

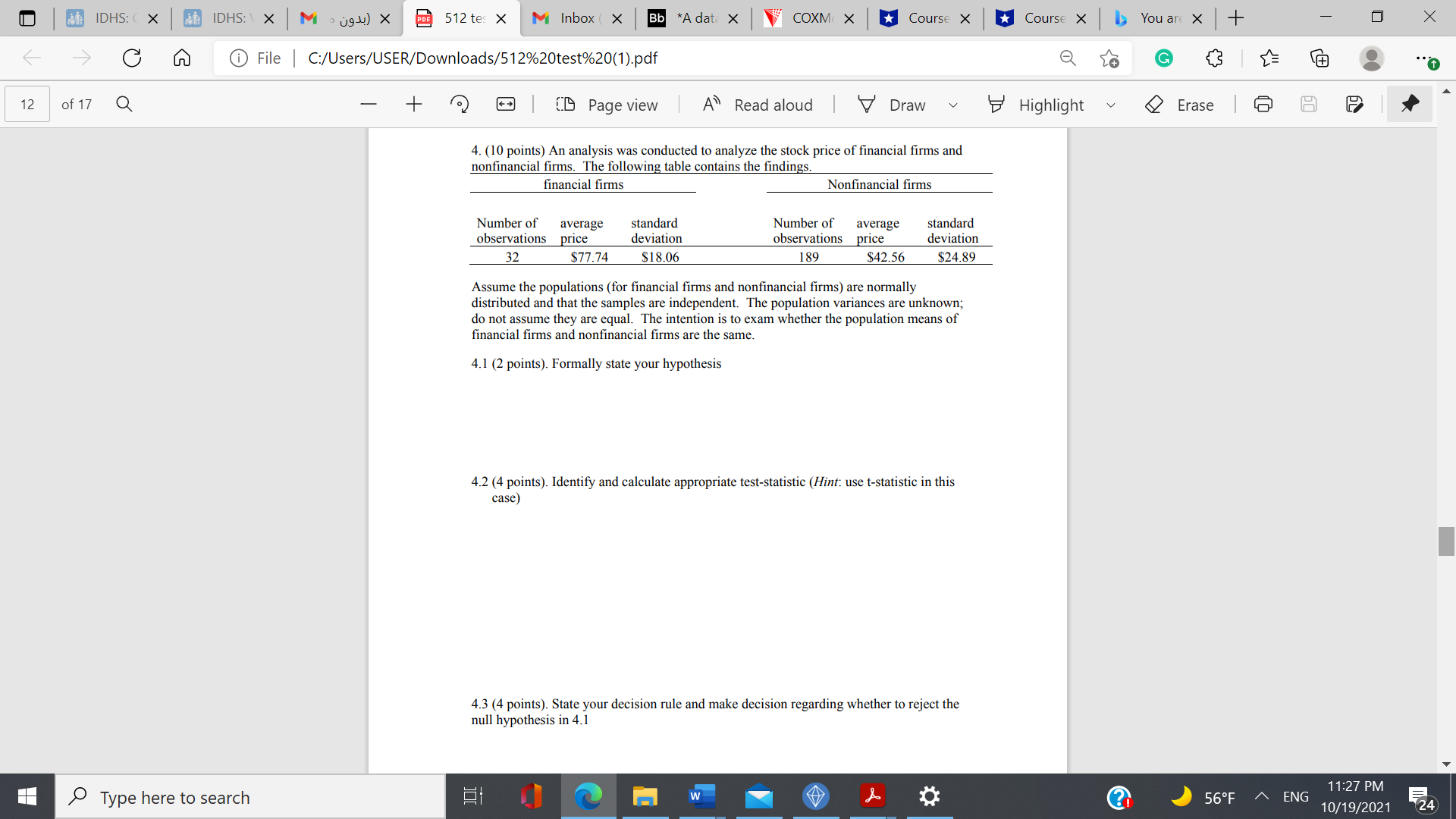

an IDHS: C X & IDHS: | X M . jgN) X (PDE 512 tes X M Inbox ( X Bb *A date X COXM X Course X Course X > You are X + X File | C:/Users/USER/Downloads/512%20test%20(1).pdf G 53 12 of 17 Q + 2 D Page view A Read aloud | Draw Highlight v Erase 4. (10 points) An analysis was conducted to analyze the stock price of financial firms and nonfinancial firms. The following table contains the findings. financial firms Nonfinancial firms Number of average standard Number of average standard observations price deviation observations price deviation 32 $77.74 $18.06 189 $42.56 $24.89 Assume the populations (for financial firms and nonfinancial firms) are normally distributed and that the samples are independent. The population variances are unknown; do not assume they are equal. The intention is to exam whether the population means of financial firms and nonfinancial firms are the same. 4.1 (2 points). Formally state your hypothesis 4.2 (4 points). Identify and calculate appropriate test-statistic (Hint: use t-statistic in this case) 4.3 (4 points). State your decision rule and make decision regarding whether to reject the null hypothesis in 4.1 Type here to search m W ENG 11:27 PM 56OF 10/19/2021 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts