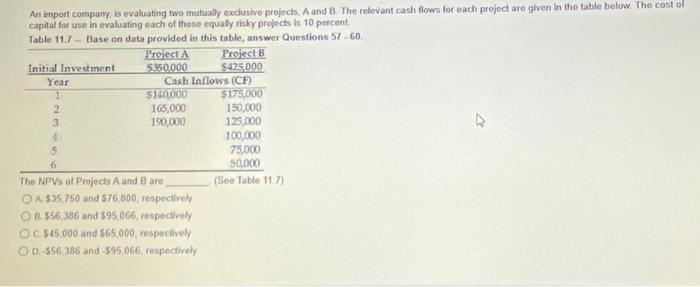

Question: An import company is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below.

An impoit company, is evaluating two mutualy exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equaly risky projects is 10 percent. Table 11.7 - Base on daba provided in this table, answer Questions 57 - 60. The NPVs of Projects A and B are (See Table 11.7) A 535,750 and 576,000, respectively Q. 556,386 and 595,066, respectively C. 545,000 and $65,000, respectively D. 556,386 and 595,066, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts