Question: An important difference between CAPM and APT is CAPM depends on risk - relum dominance; APT depends on a no arbitrage condition, CAPM assumes marry

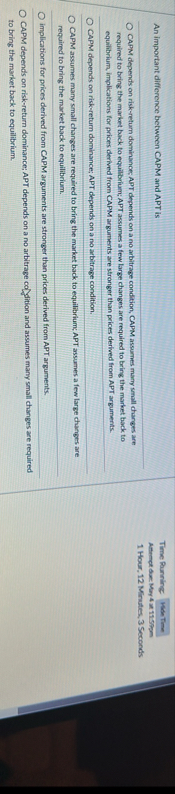

An important difference between CAPM and APT is

CAPM depends on riskrelum dominance; APT depends on a no arbitrage condition, CAPM assumes marry small charges are required to bring the market buck to equilbrium; APT assumes a few large changes are required to bring the market back to equilibrium, implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments.

CAPM depends on riskreturn dominance; APT depends on a no arbitrage condition.

CAPM assumes many small changes are required to bring the market back to equilibriums, APT assumes a few large changes are required to bring the market back to equilibrium.

implications for prices derlved from CAPM arguments are stronger than prices derived from APT arguments.

CAPM depends on riskreturn dominance; APT depends on a no arbitrage codition and assumes many small changes are required to bring the market back to equilibrium.

Time Pounning

Mention

Nanect ore Mer at

Hour, Minutes, Seconds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock