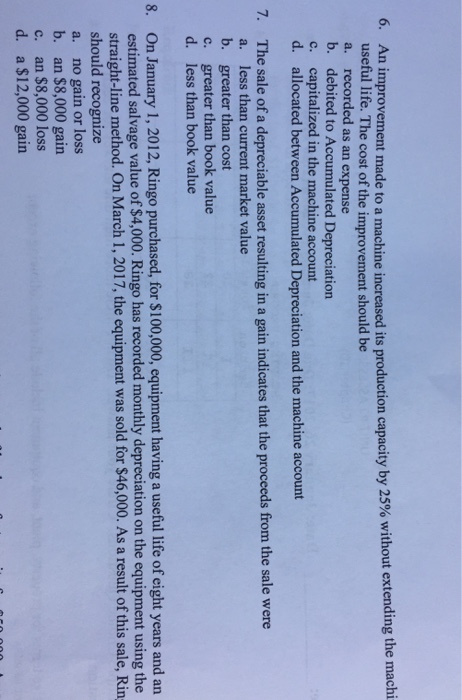

Question: An improvement made to a machine increased its production capacity by 25% without extend the machi useful life. The cost of the improvement should be

An improvement made to a machine increased its production capacity by 25% without extend the machi useful life. The cost of the improvement should be recorded as an expense debited to Accumulated Depreciation capitalized in the machine account d. allocated between Accumulated Depreciation and the machine account The sale of a depreciable asset resulting in a gain indicates that the proceeds from the sale were less than current market value greater than cost greater than book value less than book value On January 1, 2012, Ringo purchased, for $100,000, equipment having a useful life of eight years and an estimated salvage value of $4,000. Ringo has recorded monthly depreciation on the equipment using the straight-line method. On March 1, 2017, the equipment was sold for $46,000. As a result of this sale, Ringo should recognize no gain or loss an $8,000 gain an $8,000 loss a $12,000 gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts