Question: An increase in the flotation costs associated with issuing new common stock. An increase in expected inflation. Question 25 1 pts A company just paid

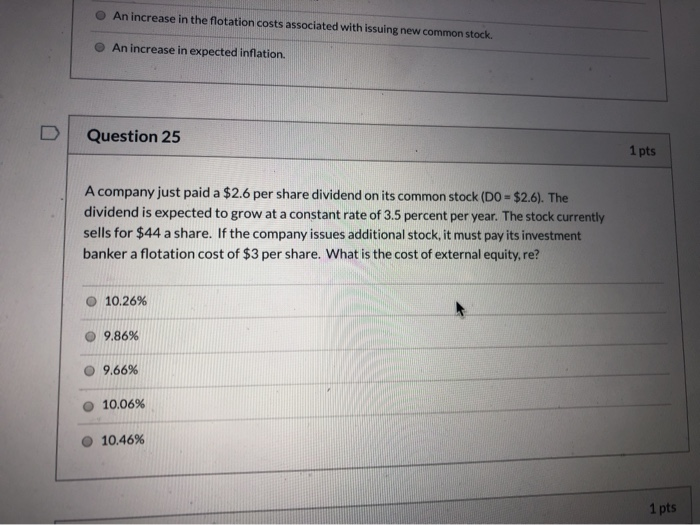

An increase in the flotation costs associated with issuing new common stock. An increase in expected inflation. Question 25 1 pts A company just paid a $2.6 per share dividend on its common stock (DO - $2.6). The dividend is expected to grow at a constant rate of 3.5 percent per year. The stock currently sells for $44 a share. If the company issues additional stock, it must pay its investment banker a flotation cost of $3 per share. What is the cost of external equity,re? 10.26% 9.86% 9.66% 10.06% 10.46% 1 pts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock