Question: An independent valuation consultancy is undertaking an assignment for a new client. In your role as investment analyst at the consultancy, you have been

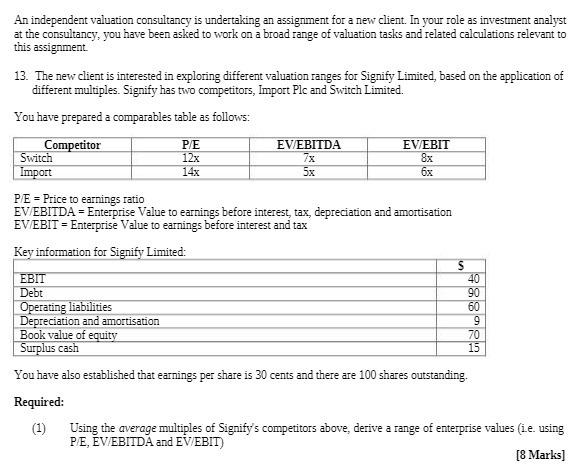

An independent valuation consultancy is undertaking an assignment for a new client. In your role as investment analyst at the consultancy, you have been asked to work on a broad range of valuation tasks and related calculations relevant to this assignment. 13. The new client is interested in exploring different valuation ranges for Signify Limited, based on the application of different multiples. Signify has two competitors, Import Plc and Switch Limited. You have prepared a comparables table as follows: Competitor Switch Import P/E 12x 14x EBIT Debt EV/EBITDA 7x 5x EV/EBIT 8x 6x P/E - Price to earnings ratio EV/EBITDA = Enterprise Value to earnings before interest, tax, depreciation and amortisation EV/EBIT = Enterprise Value to earnings before interest and tax Key information for Signify Limited: S 40 00322 90 Operating liabilities Depreciation and amortisation Book value of equity Surplus cash You have also established that earnings per share is 30 cents and there are 100 shares outstanding. Required: (1) 60 9 70 15 Using the average multiples of Signify's competitors above, derive a range of enterprise values (i.e. using PE, EV/EBITDA and EV/EBIT) [8 Marks]

Step by Step Solution

There are 3 Steps involved in it

To derive a range of enterprise values for Signify Limited using the average multiples of its compet... View full answer

Get step-by-step solutions from verified subject matter experts