Question: An individual with a mean-variance utility function is faced with four mutually exclusive investment opportunities; A, B, C and D. The NPV of each investment

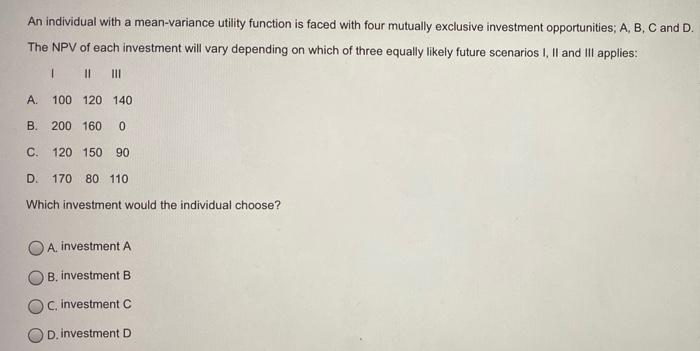

An individual with a mean-variance utility function is faced with four mutually exclusive investment opportunities; A, B, C and D. The NPV of each investment will vary depending on which of three equally likely future scenarios I, II and III applies: 1 11 III A. 100 120 140 B. 200 160 0 C. 120 150 90 D. 170 80 110 Which investment would the individual choose? A. investment A B. investment B C. investment C D. investment D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts