Question: An injection molding machine can be purchased and installed for $100,000. It is in the seven- year MACRS property class and is expected to be

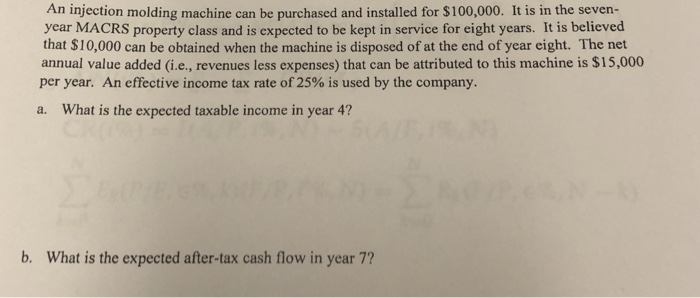

An injection molding machine can be purchased and installed for $100,000. It is in the seven- year MACRS property class and is expected to be kept in service for eight years. It is believed that $10,000 can be obtained when the machine is disposed of at the end of year eight. The net annual value added (i.e., revenues less expenses) that can be attributed to this machine is $15,000 per year. An effective income tax rate of 25% is used by the company. What is the expected taxable income in year 4? a. b. What is the expected after-tax cash flow in year 7

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock