Question: An interest rate option allows a floating-rate borrower to cap their interest rate risk, but also reap the benefits if interest rates fall. Question 1

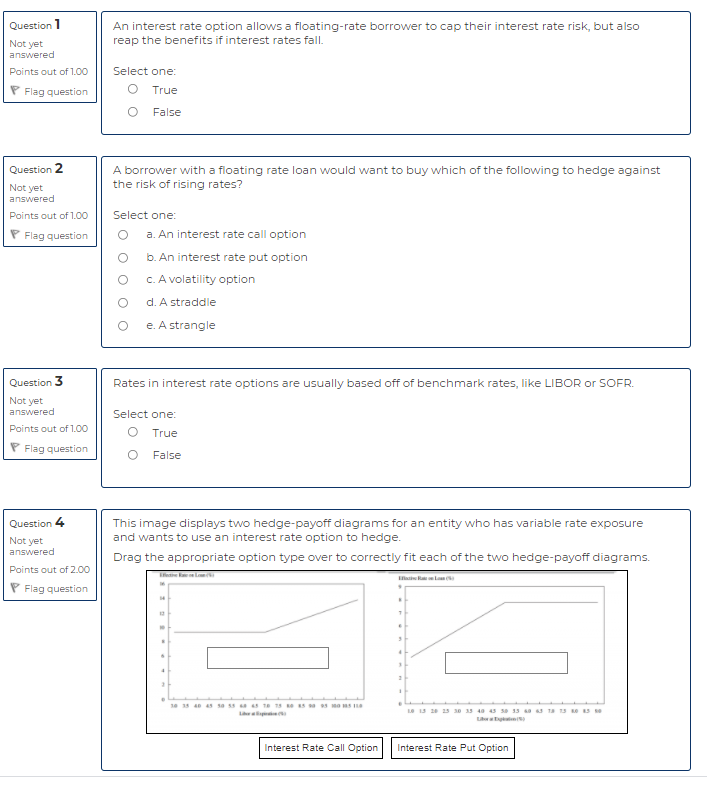

An interest rate option allows a floating-rate borrower to cap their interest rate risk, but also reap the benefits if interest rates fall. Question 1 Not yet answered Points out of 1.00 P Flag question Select one O True False A borrower with a floating rate loan would want to buy which of the following to hedge against the risk of rising rates? Question 2 Not yet answered Points out of 1.00 P Flag question O Select one: a. An interest rate call option b. An interest rate put option c. A volatility option d. A straddle e. A strangle a O O Question 3 Rates in interest rate options are usually based off of benchmark rates, like LIBOR or SOFR. Not yet answered Points out of 1.00 Select one: O True Flag question O False Question 4 Not yet answered Points out of 2.00 P Flag question This image displays two hedge-payoff diagrams for an entity who has variable rate exposure and wants to use an interest rate option to hedge. Drag the appropriate option type over to correctly fit each of the two hedge-payoff diagrams. 7 115 49 50 55 18 15 3 MOST LO 13 20 33 0 35 40 45 50 55 TL Interest Rate Call Option Interest Rate Put Option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts