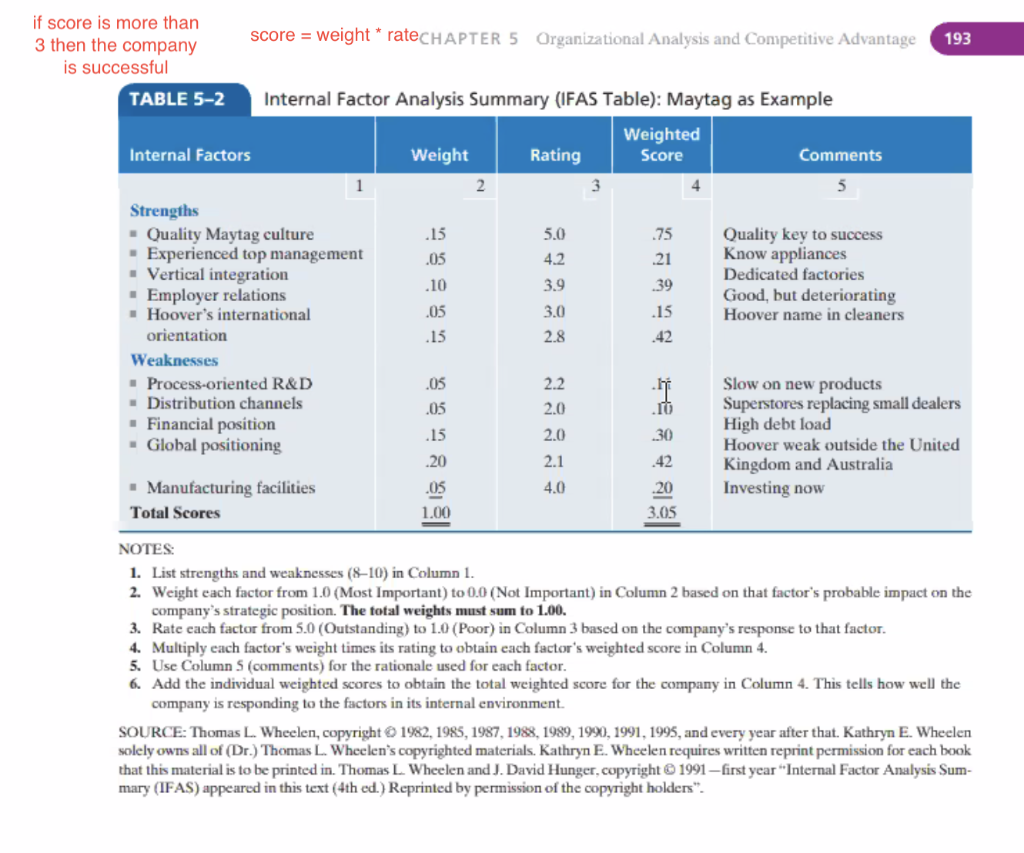

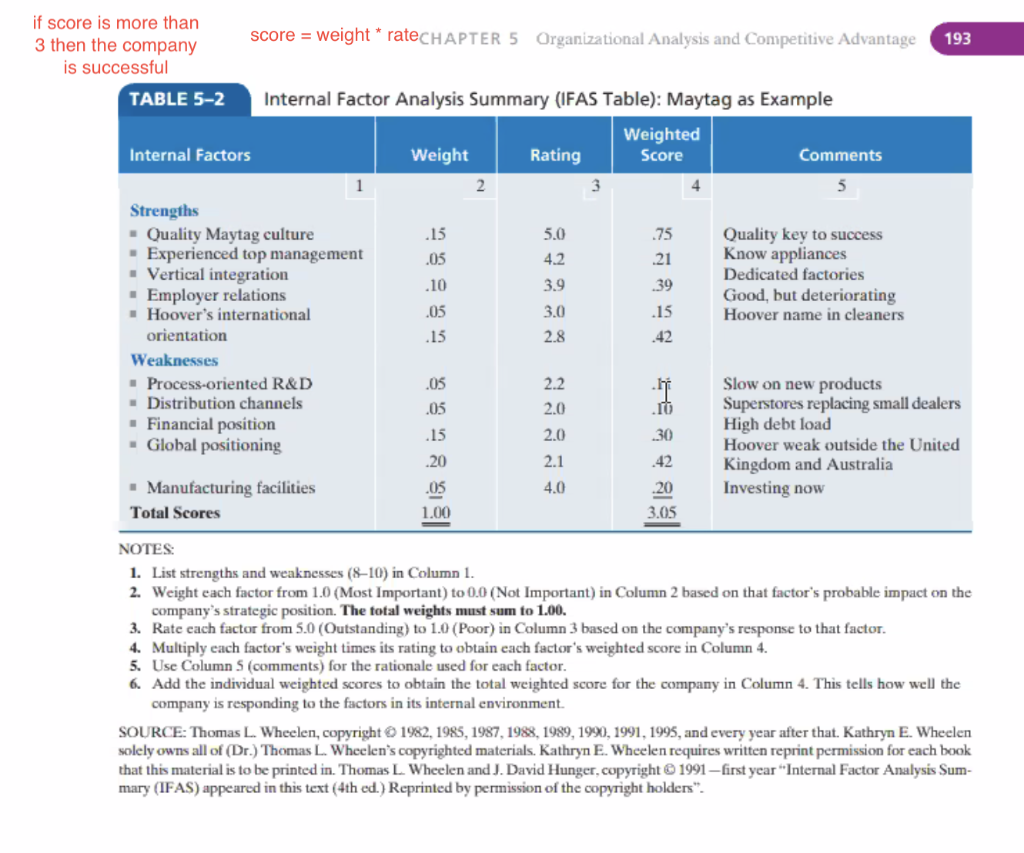

Question: An internal SWOt table should be done and another table of External swot should be done from the below nike case study as the sample

An internal SWOt table should be done and another table of External swot should be done from the below nike case study as the sample which is shown down in the blue table which consist of factors , weight , rating , weigted score and comments

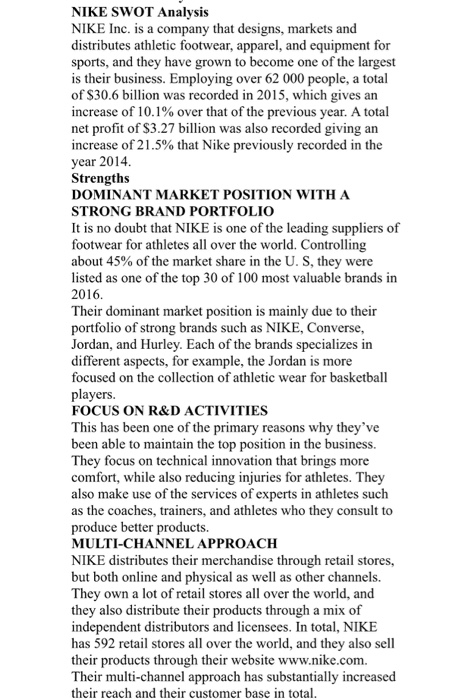

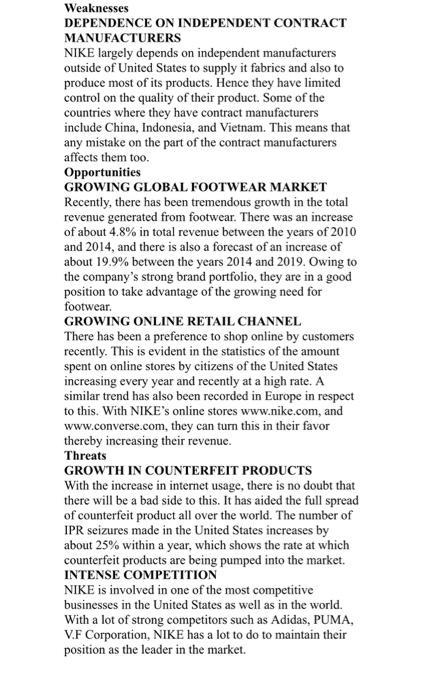

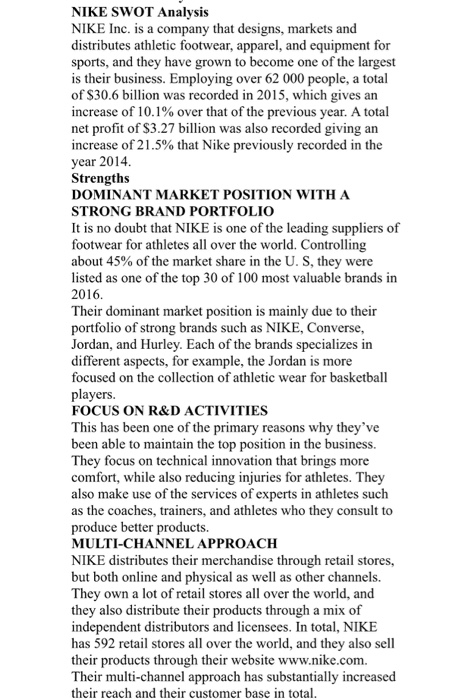

NIKE SWOT Analysis NIKE Inc. is a company that designs, markets and distributes athletic footwear, apparel, and equipment for sports, and they have grown to become one of the largest is their business. Employing over 62 000 people, a total of $30.6 billion was recorded in 2015, which gives an increase of 10.1% over that of the previous year. A total net profit of $3.27 billion was also recorded giving an increase of 21.5% that Nike previously recorded in the year 2014. Strengths DOMINANT MARKET POSITION WITH A STRONG BRAND PORTFOLIO It is no doubt that NIKE is one of the leading suppliers of footwear for athletes all over the world. Controlling about 45% of the market share in the U. S, they were listed as one of the top 30 of 100 most valuable brands in 2016. Their dominant market position is mainly due to their portfolio of strong brands such as NIKE, Converse, Jordan, and Hurley. Each of the brands specializes in different aspects, for example, the Jordan is more focused on the collection of athletic wear for basketball players. FOCUS ON R&D ACTIVITIES This has been one of the primary reasons why they've been able to maintain the top position in the business. They focus on technical innovation that brings more comfort, while also reducing injuries for athletes. They also make use of the services of experts in athletes such as the coaches, trainers, and athletes who they consult to produce better products. MULTI-CHANNEL APPROACH NIKE distributes their merchandise through retail stores, but both online and physical as well as other channels. They own a lot of retail stores all over the world, and they also distribute their products through a mix of independent distributors and licensees. In total, NIKE has 592 retail stores all over the world, and they also sell their products through their website www.nike.com. Their multi-channel approach has substantially increased their reach and their customer base in total. Weaknesses DEPENDENCE ON INDEPENDENT CONTRACT MANUFACTURERS NIKE largely depends on independent manufacturers outside of United States to supply it fabrics and also to produce most of its products. Hence they have limited control on the quality of their product. Some of the countries where they have contract manufacturers include China, Indonesia, and Vietnam. This means that any mistake on the part of the contract manufacturers affects them too. Opportunities GROWING GLOBAL FOOTWEAR MARKET Recently, there has been tremendous growth in the total revenue generated from footwear. There was an increase of about 4.8% in total revenue between the years of 2010 and 2014, and there is also a forecast of an increase of about 19.9% between the years 2014 and 2019. Owing to the company's strong brand portfolio, they are in a good position to take advantage of the growing need for footwear GROWING ONLINE RETAIL CHANNEL There has been a preference to shop online by customers recently. This is evident in the statistics of the amount spent on online stores by citizens of the United States increasing every year and recently at a high rate. A similar trend has also been recorded in Europe in respect to this. With NIKE's online stores www.nike.com, and www.converse.com, they can turn this in their favor thereby increasing their revenue. Threats GROWTH IN COUNTERFEIT PRODUCTS With the increase in internet usage, there is no doubt that there will be a bad side to this. It has aided the full spread of counterfeit product all over the world. The number of IPR seizures made in the United States increases by about 25% within a year, which shows the rate at which counterfeit products are being pumped into the market. INTENSE COMPETITION NIKE is involved in one of the most competitive businesses in the United States as well as in the world. With a lot of strong competitors such as Adidas, PUMA, V.F Corporation, NIKE has a lot to do to maintain their position as the leader in the market. score = weight * rateCHAPTER 5 Organizational Analysis and Competitive Advantage 193 if score is more than 3 then the company is successful TABLE 5-2 Internal Factor Analysis Summary (IFAS Table): Maytag as Example Weighted Weight Rating Score Comments Internal factors 2 .15 5.0 4.2 .75 .21 .05 Quality key to success Know appliances Dedicated factories Good, but deteriorating Hoover name in cleaners .10 .05 Strengths Quality Maytag culture Experienced top management Vertical integration - Employer relations Hoover's international orientation Weaknesses Process-oriented R&D Distribution channels Financial position Global positioning 3.9 3.0 2.8 .39 .15 .42 .15 .05 .05 2.2 2.0 10 .30 .15 2.0 Slow on new products Superstores replacing small dealers High debt load Hoover weak outside the United Kingdom and Australia Investing now .20 2.1 .42 4.0 - Manufacturing facilities Total Scores .05 1.00 .20 3.05 NOTES: 1. List strengths and weaknesses (8-10) in Column 1. 2. Weight each factor from 1.0 (Most Important) to 0.0 (Not Important) in Column 2 based on that factor's probable impact on the company's strategic position. The total weights must sum to 1.00. 3. Rate cach factor from 5.0 (Outstanding) to 1.0 (Poor) in Column 3 based on the company's response to that factor. 4. Multiply each factor's weight times its rating to obtain each factor's weighted score in Column 4. 5. Use Column (comments) for the rationale used for each factor. 6. Add the individual weighted scores to obtain the total weighted score for the company in Column 4. This tells how well the company is responding to the factors in its internal environment. SOURCE: Thomas L. Wheelen, copyright 1982, 1985, 1987, 1988, 1989, 1990), 1991, 1995, and every year after that. Kathryn E. Wheelen solely owns all of (Dr.) Thomas L. Wheelen's copyrighted materials. Kathryn E. Wheelen requires written reprint permission for each book that this material is to be printed in. Thomas L. Wheelen and J. David Hunger,copyright 1991 first year "Internal Factor Analysis Sum- mary (IFAS) appeared in this text (4th ed.) Reprinted by permission of the copyright holders