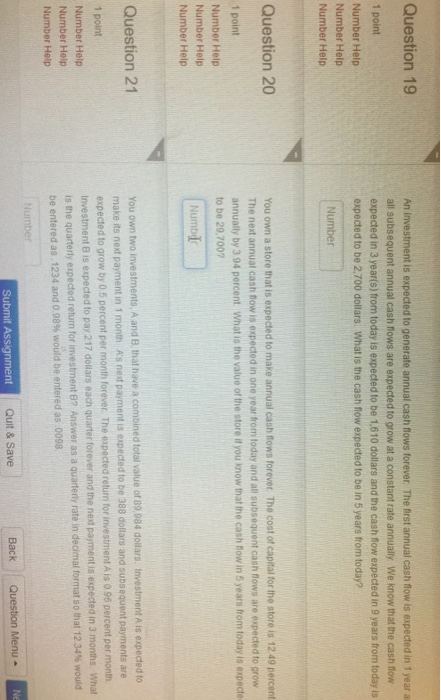

Question: An investment is expected to generate annual cash flows forever. The first annual cash flow is expected in 1 year all subsequent annual cash flows

An investment is expected to generate annual cash flows forever. The first annual cash flow is expected in 1 year all subsequent annual cash flows are expected to grow at a constant rate annually. We know that the cash flow expected in 3 year(s) from today is expected to be 1,610 dollars and the cash flow expected in 9 years from today is expected to be 2,700 dollars. What is the cash flow expected to be in 5 years from today? You own a store that is expected to make annual cash flows forever. The cost of capital for the store is 12.49 percent. The next annual cash flow is expected in one year from today and all subsequent cash flows are expected to grow annually by 3.94 percent. What is the value of the store if you know that the cash flow in 5 years from today is expected to be 29,700? You own two investments, A and B, that have a combined total value of 89,984 dollars. Investment A is expected to make its next payment in 1 month. A's nest payment is expected to be 388 dollars and subsequent payments are expected to grow by 0.5 percent per month forever. The expected return for investment A is 0.96 percent per month investment B is expected to pay 217 dollars each quarter forever and the next payment is expected in 3 months. What is the quarterly expected return for investment B? Answer as a quarterly rate in decimal format so that 12.34% would be entered as 1234 and 0 98% would be entered as 0098

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts