Question: An investor having a risk aversion coefficient (A) equal to 2.0 is considering three portfolios of varying risk and return as shown in the

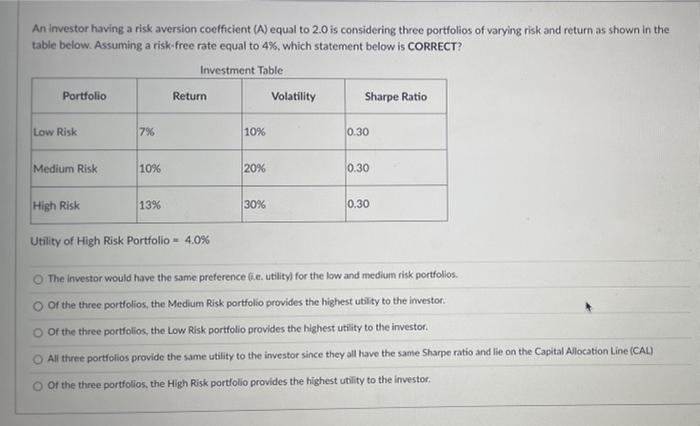

An investor having a risk aversion coefficient (A) equal to 2.0 is considering three portfolios of varying risk and return as shown in the table below. Assuming a risk-free rate equal to 4%, which statement below is CORRECT? Investment Table Portfolio Return Volatility Sharpe Ratio Low Risk 7% 10% 0.30 Medium Risk 10% 20% 0.30 High Risk 13% 30% 0.30 Utility of High Risk Portfolio - 4.0% O The investor would have the same preference (e. utility) for the low and medium risk portfolios. O Of the three portfolios, the Medium Risk portfolio provides the highest utility to the investor. O Of the three portfolios, the Low Risk portfolio provides the highest utility to the investor. O All three portfolios provide the same utility to the investor since they all have the same Sharpe ratio and lie on the Capital Allocation Line (CAL) O Of the three portfolios, the High Risk portfolio provides the highest utility to the investor.

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Using Utility theory Utility ER O5 A o where ER is the expec... View full answer

Get step-by-step solutions from verified subject matter experts